Disputing a PINless Debit Adjustment

You dispute a PINless Debit Adjustments using the same method as other eComm chargebacks. This section describes the process. See Managing Chargebacks for additional information.

Viewing PINless Debit Adjustments

The Returned Payments Report provides a view of all Chargebacks, eCheck ACH returns, Direct Debit returns, rejected payments, and PINless Debit Adjustments associated with the active organization/reporting group. The report includes a summary panel and four tabs--one for each type of returned payment. The report also includes Hyperlinks for the Payment IDs associated with each PINless Debit Adjustment. Note that transaction-level data is available for the previous 24 months only.

You can also access the Returned Payments report from the Activity Report, Settlement Report, or Reconciliation Dashboard when you click an amount hyperlink from certain fields in each report.

To view PINless Debit Adjustments in iQ from the Returned Payments report:

-

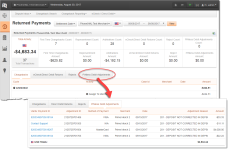

From the iQ Bar, click the Chargebacks icon and choose Chargeback Reporting - Returned Payments from the list of available reports, or from the Chargebacks Navigation bar. The Returned Payments page displays as shown below.

-

Select the desired Date Range, Reporting Group, and Currency (if applicable), then click View to refresh the page.

-

Click the PINless Debit Adjustments tab below the summary panel.

The PINless Debit Adjustments tab provides information on all adjustments associated with the selected time period and reporting group. PINless Debit Adjustments are listed by Payment ID. Make note of the Adjustment ID for use with the dispute request.

Information on the tab also includes a reason code. PINless Adjustment disputes usually have a generic reason code that fit multiple situations rather than a specific code as with Visa and Mastercard disputes. See Common Adjustment Reason Codes.

-

Click an individual Payment ID hyperlink to navigate to the Transaction Detail screen for further information on the selected PINless Debit Adjustment.

Returned Payment Screen with PINless Debit Adjustment Tab Selected

Requesting a Reversal

If you wish to dispute a PINless Debit Adjustment, you must request a reversal within 10 days of the adjustment date (time frames vary by network; you may have more or less time for the reversal). Every effort will be made to accommodate your request if it's received more than 10 days after the adjustment date.

To request a reversal:

-

Navigate to the Dispute Inbox or the Chargeback Search to locate the desired PINless Debit Adjustment.

To identify a PINless Debit Adjustment in the list of cases:

-- Refer to the Reason Code column of either the Dispute Inbox or Chargeback Search results screen: PINless Debit Adjustment codes are three-digit numeric values. See Common Adjustment Reason Codes for a partial listing.

-- A value of Vantiv Auth appears in the Payment Processor field of the Chargeback Case Detail screen for PINless Debits Adjustments. -

Click on the Case ID. The Chargeback Case Detail Screen appears.

-

Select the Merchant Represent button from the Activity Button panel at the top of the page. The Merchant Represent dialog box appears.

-

Follow the instructions for Attaching Support Documents to Your Case. All reversal requests require supporting documentation.

The Worldpay PIN Disputes team reviews your request to determine whether the dispute is valid. If the dispute is valid, a reversal is processed to credit your account and debit the card issuer. The average turnaround time for reversals is (5) business days. The card issuer has approximately 30 days to accept or deny the reversal request. If the issuer denies the request, another adjustment is processed to your account. If the issuer accepts the request, the process is complete.

Contact Information

If you have questions about the PINless Debit Adjustment dispute, call 800-667-9604 or your Relationship Manager, or email your question to PINDisputeMailbox@fisglobal.com.

Common Adjustment Reason Codes

The table below lists Reason Codes commonly seen for PINless Debit Adjustments. Compelling evidence refers to a broad category covering many reasons. See PINless Debit Adjustment Codes for the entire list of reason codes.

|

Code |

Description |

Possible Responses |

|---|---|---|

| 102, 140, 606 | Customer charged, did not receive merchandise |

|

| 144 | No cardholder authorization (fraud) |

|

| 605 | Canceled recurring transaction |

|

| 613 | Credit not received |

|

| 619 | Duplicate processing/paid by other means |

|

Examples of Compelling Evidence

-

Photographs or emails to prove a link between the person receiving the merchandise or services and the cardholder, or to prove that the cardholder disputing the transaction is in possession of the merchandise and/or is using the merchandise or services.

-

For a Card-Absent environment transaction in which the merchandise is delivered, documentation (evidence of delivery and time delivered) that the item was delivered to the same physical address for which you have received an AVS match of Y or M. A signature is not required as evidence of delivery. Provide the name of the shipping company and a tracking number.

-

For an eCommerce Transaction representing the sale of digital goods downloaded from your website or application, a description of the merchandise or services successfully downloaded, the date and time such merchandise or services were downloaded, and two or more of the following:

-

Purchaser's IP address and the device geographical location at the date and time of the transaction.

-

Device ID number and name of device (if available).

-

Purchaser's name and email address linked to the customer profile held by the merchant.

-

Evidence that the profile set up by the purchaser on the your website or application was accessed by the purchaser and has been successfully verified by the merchant before the transaction date.

-

Proof that your website or application was accessed by the cardholder for merchandise or services on or after the transaction date.

-

Evidence that the same device and card used in the disputed transaction were used in any previous transaction that was not disputed.

-