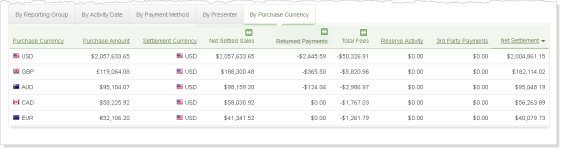

Activity Report by Purchase Currency

The By Purchase Currency tab provides a granular view of settlement amounts based upon the currencies used in the transaction. This tab appears only when the parent organization (the group displayed in the Summary frame) processes and/or settles in multiple currencies. Initially, iQ sorts the data based upon the Net Settlement Amount.

See the table below for a description of all the fields in the Summary panel and the granular data tabs of the Activity Report.

Activity Report - By Purchase Currency

|

Field |

Description |

|

Activity Date

|

The date that Worldpay processed the transaction, based on your organization’s cut-off time. The cut-off time is specified in your merchant agreement. This field appears when viewing the data By Activity Date. |

|

Deposit Reversals |

The total amount of Deposit Reversals before the deduction of any fees, reserves, or chargebacks. This field appears on the Summary panel, and in the granular data tabs when the Net Settled Sales column is split (see Split and Join Columns for more information). |

|

Method of Payment |

The method of payment (Mastercard, Visa, Discover, PayPal, etc.) for these transactions. This field appears when viewing data By Payment Method. |

|

Net Settled Sales |

The total settled funds (Settled Deposits minus Settled Refunds, Deposit Reversals, and Push to Card, plus Refund Reversals) before the deduction of any fees, reserves, or chargebacks. In the granular data tabs, use the Split icon ( |

|

Net Settlement |

The net amount transferred to your organization’s bank account. |

|

Passthrough Fees |

The amount of funds associated with charges assessed by parties other than Worldpay (for example, interchange fees). This field appears on the Summary panel, and in the granular data tabs when the Total Fees column is split (see Split and Join Columns for more information). If you sell in multiple currencies, this only reflects the Passthrough Fees for the selected currency. To view a report with more details about the fees in this field, click the desired fee amount link (not available when viewing data By Purchase Currency). For more information, see the Fee Report. |

|

Presenter |

The presenter who submitted the transaction.This field appears when viewing the data By Presenter. Note: If your organization self-presents, this field displays your organization name. |

|

Purchase Amount |

The amount of the purchase in the designated currency. This field appears when viewing the data By Purchase Currency. |

|

Purchase Currency |

The currency used for the purchase, designated by a flag icon and a three-letter abbreviation of the country. This field appears when viewing the data By Purchase Currency. |

|

Refund Reversals |

The total amount of Refund Reversals before the deduction of any fees, reserves, or chargebacks. This field appears on the Summary panel, and in the granular data tabs when the Net Settled Sales column is split (see Split and Join Columns for more information). |

|

Reporting Group |

The Reporting Group to which the data applies. If a hierarchy of groups exist, you can expand the information to show sub-groups by clicking the plus sign next to the group name. This field appears when viewing the data By Reporting Group. |

|

Reserve Activity |

The changes made to the reserve fund based upon gross sales. If you sell in multiple currencies, this only reflects the Reserve Activity for the selected currency. To view a report with more details about the Reserve Activity in this field, click the desired Reserve Activity amount link (not available when viewing data By Purchase Currency). For more information, see the Reserve Report. |

|

Returned Payments |

The amount of funds associated with chargebacks, Direct Debit (eCheck) returns, rejected payments, and PINless Debit adjustments, including:

In the granular data tabs, this column can be split to show a breakdown of Chargebacks/Returns and Rejected Payments using the Split icon ( To view a report with more details about the returned payments amounts in this field, click the desired returned payments amount link. (not available when viewing data By Purchase Currency). For more information, see Returned Payments Report. |

|

Settled Deposits |

The total amount of settled deposits before the deduction of any fees, reserves, or chargebacks. This field appears on the Summary panel, and in the granular data tabs when the Net Settled Sales column is split (see Split and Join Columns for more information). |

|

Settled Refunds |

The total amount of settled refunds before the deduction of any fees. This field appears on the Summary panel, and in the granular data tabs when the Net Settled Sales column is split (see Split and Join Columns for more information). |

|

Settled Transactions |

The number of transactions that were settled in the specified time period. This field appears in the Summary Panel, By Presenter, and By Payment Method panels only. In the Summary panel, this field may include a CSV Export icon ( |

|

Settlement Currency |

The currency used for the settlement, designated by a flag icon and a three-letter abbreviation of the country. This column appears when viewing data By Reporting Group and By Purchase Currency. |

|

Settlement Date

|

The date that Worldpay sent the settled funds (less fees and/or reserve/chargebacks) to your organization’s bank. If the funds transfer has been held or delayed, the column displays Transfer Pending. This field appears when viewing the data By Activity Date. Note: The transit time depends on the method of fund transfer (for example, via wire transfer or Automated Clearing House - ACH). Your merchant contract specifies the transit type. |

|

Total Fees |

The amount of funds associated with transaction processing charges (Worldpay Fees) plus other fees, e.g., interchange (Passthrough Fees). In the granular data tabs, this column can be split to show a breakdown of Worldpay Fees and Passthrough Fees using the Split icon ( To view a report with more details about the fees in this field, click the desired fee amount link (not available when viewing data By Purchase Currency). For more information, see the Fee Report. |

|

Third Party Payments |

The fees paid to a third party by Worldpay on behalf of your organization. |

|

Worldpay Fees |

The amount of funds associated with transaction processing charges. If you sell in multiple currencies, this only reflects the Worldpay Fees for the selected currency. This field appears on the Summary panel, and in the granular data tabs when the Total Fees column is split (see Split and Join Columns for more information). To view a report with more details about the fees in this field, click the desired fee amount link (not available when viewing data By Purchase Currency). For more information, see the Fee Report. |