Exporting Net Settled Sales by Transaction Data

You can export data on net settled sales (deposits minus refunds) including conveyed transactions from either the Activity or Settlement Report. The data is listed by transaction and exported to a comma separated value (csv) format file. If the option to export is available, the CSV Export icon (![]() ) is available and active (not grayed-out) in the Settled Transactions field. Transaction-level data is available for export for the previous 24 months only.

) is available and active (not grayed-out) in the Settled Transactions field. Transaction-level data is available for export for the previous 24 months only.

Settled Transactions Field with CSV Export icon

To export Net Settled Sales by transaction data from the Activity or Settlement Report:

-

From the iQ Bar, click the Financial icon and select Activity Report or Settlement Report from the list of available reports, or from the Financial Navigation bar.

-

Specify the desired Date (one day maximum), Reporting Group, and Currency and click View.

-

Click the CSV Export icon (

) next to the transaction count in the Settled Transactions field. If the CSV export icon is grayed-out, adjust your date range for a start date no earlier than 24 months prior to today.

) next to the transaction count in the Settled Transactions field. If the CSV export icon is grayed-out, adjust your date range for a start date no earlier than 24 months prior to today. -

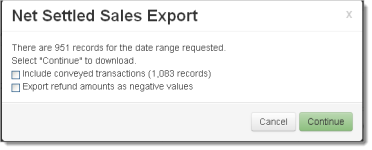

Select the check boxes that apply (‘Include conveyed transactions,’ ‘Export refund amounts as negative values’) and click Continue.

-

Open - opens the report in your default spreadsheet application (e.g., Microsoft Excel).

-

Save - saves the CSV file to your computer.

-

Cancel

Depending on your browser, a dialog box appears containing the number of records that will be exported for the date specified.

Before proceeding, note the number of records to be exported. A report with a large number of records may take an extended time to download to your system.

After clicking Continue, the File Download dialog box appears. Choose an option as follows:

The data listed in the table below are included in the file.

See Notes on Microsoft Excel for information on the presentation of certain data fields in exported files.

|

Field |

Description |

|

Reporting Group |

The Reporting Group to which the transaction applies. |

|

Merchant |

The name of the parent organization (or division) to which the transaction applies. |

|

Activity Date |

The original date of the transaction. |

|

Settlement Date |

The date that Worldpay sent the settled funds to your organization’s bank. |

|

Worldpay Payment ID |

The automatically-assigned unique identifier for this transaction. |

|

Parent Worldpay Payment ID |

The Payment ID for the parent transaction. If the transaction was an reversal, capture, or credit, for example, this is the Worldpay Payment ID for the original transaction. |

|

Merchant Order Number |

The merchant-designated identifier for this transaction. |

|

Txn Type |

The type of transaction (for example, Deposit, Refund, Reversal, etc.). |

|

Purchase Currency |

The currency used for the purchase, designated by a three-letter abbreviation of the country. |

|

Purchase Amt |

The total dollar amount of the purchase for this transaction. |

|

Settlement Currency |

The currency used for the settlement, designated by a three-character abbreviation of the country. |

|

Settlement Amt |

The settlement amount for this transaction. |

|

Payment Type |

The method of payment (Visa, Mastercard, etc.) for this transaction. |

|

Account Suffix |

The account number suffix that the customer used for this transaction. Regardless of account permissions, only the last four digits are visible for credit cards, and the last three digits for Direct Debit. |

|

BIN |

The bank identification number, which is the first six digits of the credit card number used for the transaction. This uniquely identifies the institution that issued the credit card to the card holder. |

|

Response Reason Message |

The transaction response returned by Worldpay for this transaction. If the transaction was declined, this message provides a reason. |

|

Batch ID |

An unique number automatically assigned by Worldpay for the batch associated with the transaction. |

|

Session ID |

A unique number automatically assigned by Worldpay for the session associated with the transaction. |

|

ARN |

The Acquirer Reference Number (ARN) that uniquely identifies this transaction with the networks. |

|

Interchange Rate |

The Interchange Qualification rate for this transaction, designated by the Networks. This determines the interchange rate, and subsequently the interchange fees, assessed to each transaction. |

|

Customer ID |

The unique identifier of the purchaser associated with the transaction. |

|

Merchant Transaction ID |

The identifier specified by the merchant for this transaction. This value corresponds to the id attribute (id="value") of the transaction and is used with Online transactions for Duplicate Transaction Detection. |

|

Affiliate |

The merchant-specified identifier used to track transactions associated with your affiliate organizations. |

|

Campaign |

The merchant-specified identifier used to track transactions associated with specific marketing campaigns or promotions. |

|

Merchant Grouping ID |

The merchant-specified identifier for grouping transactions by an additional transaction level ID outside of Affiliate or Campaign. |

|

Token Number |

The reference number (token) issued by Worldpay to replace the submitted credit card number or Direct Debit account number. For Amazon Pay transactions, this field displays the Amazon Pay Token number. |

|

Transaction Processing Timestamp GMT |

The date and time (GMT) the transaction was processed by Worldpay. |

|

Approximate Interchange Fee Amount |

The approximate interchange fee amount assessed for the transaction by parties other than Worldpay (passthrough fees). If the transaction is a refund, a negative value is displayed. |

|

Interchange Flat Rate |

The flat rate portion of the interchange fee assessed for this transaction. |

|

Interchange Percent Rate |

The percentage rate portion of the interchange fee assessed for this transaction. |

|

Funding Method |

The funding method for the transaction, either Conveyed (as with some American Express and Discover transactions), or settled. |

|

Issuing Bank Name |

The name of the bank associated with the BIN for this transaction. |

|

Billing Descriptor |

The custom billing descriptor text that will display on the customer’s bill. |

|

Merchant ID |

The value of the merchantId element/attribute submitted in the cnpAPI transaction. |

|

Presenter |

The presenter who submitted the transaction. If your organization self-presents, this field displays your organization name. |

|

Worldpay cpnAPI Reporting Group |

The value of the Reporting Group attribute submitted with the cnpAPI transaction. |

|

Customer Reference |

A reference string used by your customer for the purchase (for example, a Purchase Order Number). |

|

Secondary Amt |

The portion of the purchase amount that is directed to a third party. |

|

Secondary Settlement Amt |

The portion of the settlement amount that is directed to a third party. |

|

Requested Auth Amount |

The requested amount from the Authorization. |

|

Original Auth Code |

The original authorization approval code. |

|

Customer Name |

The name of the cardholder as submitted in the Bill To information. |

|

Address Line 1 |

The first line of the street address of the cardholder as submitted in the Bill To information. |

|

Address Line 2 |

The second line of the street address of the cardholder as submitted in the Bill To information. |

|

City |

The city of the cardholder as submitted in the Bill To information. |

|

State |

The state of the cardholder as submitted in the Bill To information. |

|

Postal Code |

The postal code of the cardholder as submitted in the Bill To information. |

|

Fraud Checksum Response Code |

The card validation response code. For a full list of codes, please refer to Appendix A of the Worldpay cnpAPI Reference Guide. |

|

Fraud Checksum Response Message |

A text explanation of the Fraud Checksum response code. |

|

AVS Response Code |

The response code representing the result of the Address Verification check. For a full list of codes, please refer to Appendix A of the Worldpay cnpAPI Reference Guide. |

|

AVS Response Message |

A text explanation of the AVS response code. |

|

Token Response Code |

A 3-digit code indicating the results of a transaction involving the conversion or attempted conversion of an account number to a token. |

|

Token Response Message |

A text explanation of the token response code. |

|

PINless Debit Network |

The network through which this PINless Debit adjustment was processed (NYCE, Pulse, Star, etc.). |

|

Merchant Category Code |

The Merchant Category Code associated with the merchant submitting the transaction, or associated with the transaction, if you use dynamic MCCs. |

|

Billing Profile Id |

The unique identifier of the merchant's Billing Profile within our system. |

|

Worldpay Transfer Id |

The unique transfer identifier for the transaction. |

|

Processing Endpoint |

Indicates debit transaction details and routing information for PINless debit transactions. |