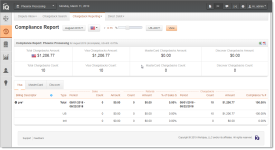

Compliance Report

Card associations (Visa, Mastercard, and Discover) require that you monitor your organization’s chargebacks to ensure that the transaction- or sales-to-chargeback ratio does not exceed 1%, and that your total chargeback count does not exceed certain thresholds in a given month, in order to remain compliant.

iQ provides two reports containing chargeback compliance data:

-

The Chargeback Summary Reportprovides a single day, at-a-glance summary of your activity for Visa, Mastercard, and Discover, as it relates to chargeback compliance. iQ displays data for the latest date for which data is available (one day), based on the Issuing Bank Day.

-

The Compliance Report contains monthly summarized chargeback data presented in the same way that each of the card associations measure this data. For example, Visa measures chargeback compliance by comparing chargebacks received in the current month to sales received in the current month, and whether you exceed the maximum threshold of 100 Visa chargebacks in the current month. The Compliance Report, therefore, presents Visa chargeback and compliance data for an entire calendar month or for the current partial month-to-date. Data is presented in a similar way for Mastercard and Discover.

To access the Compliance Report:

-

From the iQ Bar, click the Chargebacks icon and chose Chargeback Reporting - Compliance from the list of available reports, or from the Chargebacks Navigation bar. The Compliance Report appears.

-

Select the desired Month (current or prior month) and Currency (based on the selected merchant).

-

Specify the Compliance Threshold using the slide tool.

-

For example, if you wish to filter the view to determine which billing descriptors are near the maximum threshold of 1% (a value greater than 1% is out of compliance), move the slider to '

> .90 %' to filter the compliance data in the report to include billing descriptors whose ratios are greater than or equal to 90%. The default value is 'greater than 0.75%' transaction- or sales-to-chargeback ratio. -

Select the transaction Type (either US, International, or both), then click View to refresh the page. International transactions are defined as those occurring with cards issued outside of the US, based on the Bank Identification Number (BIN).

-

The Compliance Report provides summary information (chargeback counts and amounts) for each card type and detailed information in the form of tabs for each card type below the summary panel.

-

Click the desired tab below the Summary panel to view more detailed information. Your options are: