Compliance Report - Visa and Mastercard

The Visa and Mastercard tabs of the Compliance Report provide detailed information for each of the card types as it applies to chargeback compliance, and includes sales, refunds, and chargeback counts and amounts, and a percentage value representing the level of chargeback compliance.

For Visa (as shown in Compliance Report), chargeback data is rolled up by billing descriptor or prefix, then by US chargebacks, international chargebacks, and total chargebacks (depending on your selection from the US/International drop-down).

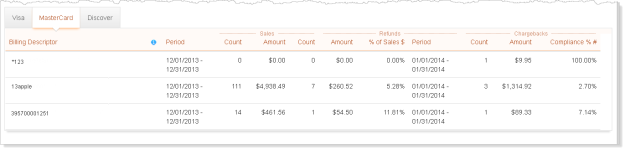

For Mastercard, data is rolled up by Mastercard ID or billing descriptor (Mastercard does not use US/International chargeback designations).

Compliance Report Detailed Tab - Mastercard

The table below describes the fields in the Visa and Mastercard tabs of the Compliance report. Online Help is available for the Compliance Report by clicking the Help icon in the top navigation bar.

|

Field |

Description |

|

Billing Descriptor |

For Visa, the billing descriptor or prefix for this data. For Mastercard, the Mastercard ID or billing descriptor for this data. iQ displays all of the available billing descriptor or prefixes for your organization. |

|

Type |

(Visa only) The type of transaction, either US or International, and total for this billing descriptor and time period. International transactions are defined as those occurring with cards issued outside of the US, based on the Bank Identification Number (BIN). |

|

Sales - Period |

The time span (month) over which the sales (and refunds) portion of the compliance calculation is measured for this billing descriptor. The period differs depending upon the payment type:

Visa measures chargeback compliance by comparing chargebacks received in the current month against sales received in the current month. Mastercard measures chargeback compliance by comparing chargebacks received in the current month against sales received in the previous month. |

|

Sales - Count |

The total number of sales that occurred within the specified month (or partial month to date) for this billing descriptor. |

|

Sales - Amount |

The total sales amount that occurred within the specified month (or partial month to date) for this billing descriptor. |

|

Refunds - Count |

The number of refunds issued in the specified month (or partial month to date) for this billing descriptor. |

|

Refunds - Amount |

The total refund amount that occurred within the specified month (or partial month to date) for this billing descriptor. |

|

Refunds - % of Sales $ |

The total refund amount that occurred within the specified month (or partial month to date), as a percentage of the total sales amount for this billing descriptor. |

|

Chargebacks - Period |

The selected month or partial month to date over which the chargeback portion of the compliance calculation is measured.This may differ from the Sales Period, depending on the payment type. |

|

Chargebacks - Count |

The number of chargebacks that occurred for this method of payment in the specified month (or partial month to date) for this billing descriptor. |

|

Chargebacks - Amount |

The total chargeback amount that occurred within the specified month (or partial month to date) for this billing descriptor. |

|

Compliance %# |

A percentage value representing the level of Chargeback compliance as it applies to Visa or Mastercard:

|