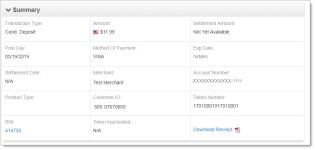

Transaction Detail - Summary Data

The Summary data panel contains general information on the transaction including amount, method of payment, account number, etc.

Account numbers and expiration dates are masked or displayed as ‘hidden.’ If you have the appropriate permissions, you can show or hide cardholder data and personal information on your screen by clicking the Show All Customer Data/Hide All Customer Data hyperlink in the upper right of the Summary data panel. Contact Customer Service for more information on permissions. The table below describes all possible fields.

When you Hide or Show All Customer Data in the Summary Data panel, other data panels with cardholder and/or personal data (Account Updater panel) are also hidden (or shown).

Transaction Detail - Summary Data

|

Field |

Description |

|

Transaction Type |

The type of transaction (Refund, Authorization, eCheck Deposit, etc.). Also, gift card transaction types (Balance Inquiry, Activate Card, Deactivate Card, etc). |

|

Amount |

The purchase amount of the transaction, or the amount of the initial value of a newly activated gift Card, the amount loaded onto a reloadable Gift Card, or the amount unloaded from a Gift Card. For some transactions, ‘Secondary amount’ is also shown in this field, often used in conjunction with a convenience fee. The Secondary amount is the principal purchase amount of the transaction, before the convenience fees, etc. For example, if the total amount is $105 (i.e. $100 principal + $5 convenience fee), the secondary amount is $100. |

|

Routing Number |

The 9-digit bank routing number for the Direct Debit (eCheck). This field appears for Direct Debit transactions only. |

|

Exp. Date |

The expiration date of the credit card used in the transaction. Displays as “hidden” unless you have appropriate permissions.This field appears for credit card transactions only. |

|

Settlement Amount |

The settlement amount transferred to your organization’s bank account. For some transactions, ‘Secondary amount’ is also shown in this field, often used in conjunction with a convenience fee. The Secondary amount is the principal settlement amount transferred to a designated bank account, before the convenience fees, etc. For example, if the total amount is $105 (i.e. $100 principal + $5 convenience fee), the secondary settlement amount is $100. |

|

Post Day |

The date the funds appear as accepted, or recognized, based on the cutoff time specified in your merchant agreement. |

|

Method of Payment |

The method of payment used for this transaction (Visa, Mastercard, PayPal, Direct Debit (eCheck), Gift Card, etc.). |

|

Account Number |

The account number that the customer used for this transaction. Only the last four digits are visible for credit cards, and the last three digits or X-XXX for Direct Debits, unless you have permission to view the full account number. |

|

Account Type |

The type of Direct Debit account (for example, Checking, Savings, or Corporate). This field appears for Direct Debit transactions only. |

|

Product Type |

The product type of the card. This field appears for card transactions only. Possible values are:

|

|

Merchant |

The organization associated with the posted transaction. |

|

Token Number |

The reference number (token) issued by Worldpay to replace the submitted credit card number or Direct Debit account number. For Amazon Pay transactions, this field displays the Amazon Pay Token number. For Access Worldpay (AWP) transactions, this field displays the AWP request token URL or the AWP response token URL in Account Update Response and Request Detail screens. |

|

Bank Name |

The name of the bank that issued the Direct Debit (eCheck). This field appears for Direct Debit transactions only. |

|

BIN |

The Bank Identification Number (first six digits of the card number). If available, click the link to view the BIN Lookup with Results screen (see the Session Activity Report for more information). This is available for Mastercard, Visa, and Discover only. |

|

Customer ID |

The unique identifier of the purchaser associated with this transaction. |

|

Token Inactivated Date |

The date/time the token associated with this transaction was inactivated (if the token was inactivated). |

|

Bank Phone |

The phone number of the bank that issued the Direct Debit. This field appears for Direct Debit (eCheck) transactions only. |

|

Cycle |

The number of times an Direct Debit (eCheck) redeposit has been attempted (for example, Initial, 0, 1, or 2). This field appears for Direct Debit transactions only. |

|

Check Number |

The check number for the Direct Debit (eCheck).This field appears for Direct Debit transactions only. |

|

Company Name |

The merchant name for use in Direct Debit (eCheck) transactions. This field appears for Direct Debit transactions only. |

|

Authentication Value |

The Visa Cardholder Authentication Verification Value (CAVV) or the Mastercard Universal Cardholder Authentication Field (UCAF). This field appears for Visa and Mastercard transactions only. |

|

Click this hyperlink to download a PDF receipt of a deposit or refund transaction (as shown in Virtual Terminal). Includes the following information: Merchant Name, Worldpay Payment ID, Merchant Order number, Billing Descriptor, Customer ID, Transaction Type, Purchase currency, amount, date, and last four digits of the account number. |