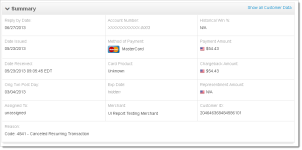

Case Detail Summary Data

The Case Detail Summary Data panel contains general information on the chargeback including reply-by date, amount, method of payment, account number, etc.

Account numbers and expiration dates are masked or displayed as ‘hidden.’ If you have the appropriate permissions, you can show or hide cardholder data and personal information on your screen by clicking the Show All Customer Data/Hide All Customer Data hyperlink in the upper right of the Summary data panel. Contact Customer Service for more information on permissions. The table below describes all possible fields.

Case Detail Summary

|

Field |

Description |

|

Reply By |

The latest possible date for merchants to dispute a case. During the last five days before the due date, when a chargeback is in danger of expiring, this field displays a red exclamation point ( |

|

Account Number |

The account number that the customer used for this transaction. Only the last four digits are visible for credit cards, and the last three digits for Direct Debit, unless you have permission to view the full account number. |

|

Token Number |

The reference number (token) issued by Worldpay to replace the submitted credit card number, or Direct Debit account number. For Amazon Pay transactions, this field displays the Amazon Pay Token number. |

|

A percentage value, ranging from 0% to 95% indicating the probability that a representment will be “won,” based on past results. Other possible values are:

See Understanding the Historical Win Percentage for more detailed information on this field. |

|

|

Date Issued |

The date the issuing bank submitted the chargeback. |

|

Method of Payment |

The method of payment used for this transaction (Visa, Mastercard, PayPal, Direct Debit, etc.). |

|

Payment Amount |

The amount the consumer originally paid. |

|

Date Received |

The date that Worldpay received the chargeback from the network. |

|

Card Product |

Indicates if the card used is a commercial or consumer card. |

|

Chargeback Amount |

The amount of the chargeback. |

|

Orig Txn Post Day |

The date the funds from the original transaction appeared as accepted, or recognized. |

|

Exp. Date |

The expiration date of the credit card used in the transaction. Displays as “hidden” unless you have appropriate permissions. This field appears for credit card transactions only. |

|

Representment Amount |

The amount of money disputed in the representment. This amount is assigned by means of Performing a Chargeback Activity as described Performing a Chargeback Activity. |

|

Assigned To |

The Chargeback analyst from your organization assigned to this chargeback case (can also be ‘unassigned’). |

|

Merchant |

The organization responsible for working the case through the chargeback process. |

|

Customer ID |

The unique identifier of the purchaser associated with this transaction. |

|

Reason Code |

The code used to provide additional information to the receiving clearing member regarding the nature of a chargeback, subsequent presentment, fee collection, funds disbursement, or request for a source document. (See VCR Dispute Reason Codes in Return Reason and Change Codes for more information on Visa reason codes.) |

) next to the field. We recommend working chargebacks immediately when they arrive. A red clock (

) next to the field. We recommend working chargebacks immediately when they arrive. A red clock (