Dynamic Payout Dashboard

The Dynamic Payout Dashboard reporting is available to Payment Facilitators who utilize the Dynamic Payout solution for funding sub-merchants, as well as direct merchants who utilize the Dynamic Payout solution for funding non-boarded entities (e.g., gaming merchant payouts to 'winners'). The reporting provides account balances and detailed information on the funding instructions and activities for each account type (Settlement, Reserve, and American Express-Conveyed as well as your own Operating account) to assist you with reconciliation.

For U.S. Dynamic Payout clients the accounts listed in the Dynamic Payout Dashboard are stored value accounts (also known as a wallet) set up by Worldpay on behalf of RealNet Payments LLC (RNPLLC), and are managed and reconciled by RNPLLC. These accounts include funds accumulated in bank accounts held by RNPLLC from settled transactions, generally in For Benefit of (FBO) accounts. For Canadian Dynamic Payout clients, settled transactions accumulate in an FBO account owned by Peoples Bank of Canada. iQ does not display Reserve and American Express information in the reporting for Canadian clients.

The data in the Dynamic Payout Dashboard changes frequently due to the receipt of the various transaction data files throughout the day.

To view Dynamic Payout Dashboard reporting:

-

From the iQ Bar, click the Financial icon and select Dynamic Payout Reconciliation.

-

Click Dynamic Payout Dashboard from the list of available reports, or from the Financial Navigation bar. The Dynamic Payout Reconciliation displays as shown below.

-

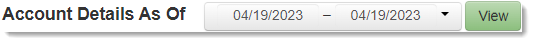

Select the desired Date Range in the Account Details As Of selector (located below the account balance fields) and click View to refresh the page.

The default view is for current day only. You can view line item activities for previous dates and date ranges, however the amounts shown in the account balance fields remain unchanged and show current day only. For more information, see Account Details As Of Panel below.

-

Click the desired tab to the change the account type of the Account Details As Of panel, either Settlement, Reserve, or Amex.

-

Click the plus sign next a date to expose the activity types for that date (for example, Vendor funding, Sub-merchant funding, etc.). To expand or collapse all levels of granular data, click the plus/minus sign next to Expand All or Collapse All.

You can export transaction-level instruction data to a CSV file for all instructions as well as Held Instructions. See Exporting Transaction-Level Held Instruction Data for more information.

Dynamic Payout Dashboard

|

Field |

Description |

|

Actual Balance |

The balance of your stored value account (also known as FBO Settlement Account) held with RNPLLC (i.e., the total dollar amount at a given time of cleared/confirmed transactions). The FBO Settlement account holds settlement funds for Visa, Mastercard, Discover, American Express, Direct Debit, and Funding Instruction transactions. For a more up-to-date balance of funds credited to your stored value account , and the total amount against which you can issue funding instructions--based on Actual Balance plus anticipated pending settlement--see the Projected Available Balance field. |

|

Pending Funding Instruction Credits |

The total dollar value of incoming funds that will be settled to your stored value (FBO) account when confirmed by the bank. These are instructions issued to transfer funds from an outside financial institution's operating account that have not yet cleared. |

| Pending Funding Instruction Debits |

The total dollar value of outgoing funds that will be disbursed from your stored value (FBO) balance when confirmed as cleared by the bank. These are instructions issued to transfer funds to an outside financial institution's operating account from your stored value balance account.

|

|

Held Funding Instructions |

The total dollar value of instructions that were initially held due to sanction screening. Click the CSV Export icon ( Only actual held instructions display on the report, as well as any initially held instructions that were then reviewed and released for processing, when their status was updated within the last 14 days. After 14 days, the Instruction/Payment ID is removed from the report. See Held Funding Instructions for more information. |

|

Pending Net Settled Sales |

The balance of any non-confirmed net settled sales from either the Core or eComm platform processed on your Chain/Org that should credit/debit your stored value (FBO) settlement account and increase or decrease the Projected Available Balance shown. Some merchants do not use this settlement process; therefore the balance shown is always zero dollars. |

|

Projected Available Balance |

The amount of funds that you can issue funding instructions against (per the ‘as-of’ date and time shown). The Projected Available Balance is the sum of the Actual Balance + Pending Funding Instruction Credits - Pending Funding Instruction Debits - Held Funding Instructions +/- Pending Net Settled Sales. |

|

Reserve Balance |

The balance of the FBO Reserve account, when utilized by your organization. This field is not applicable to Canadian Dynamic Payout PayFac clients. |

|

Amex Balance |

If processing American Express-conveyed transactions, use this to track the amount of American Express sales pending settlement to your stored value (FBO) account balance. This is based on your agreement with American Express to settle those sales directly to Worldpay and the FBO settlement account owned by RNPLLC. This field is not applicable to Canadian Dynamic Payout clients. |

Account Details As Of Panel

The Account Details As Of panel of the Dynamic Payout Dashboard contains additional granular data for Settlement, Reserve, and American Express accounts. Select the desired tab for each account type. The table below describes information presented in each of the columns.

|

Column |

Description |

|---|---|

| Date |

The date of the funds transfer activity (bank settlement day). |

|

Type |

The type of Funding Instruction activity related to the funds transfer for the selected account. (M) denotes that a manual adjustment has been applied to the transaction. See more information on Manual Adjustments below.

|

|

Instruction Count |

The total number of funding instructions issued (both credit and debit) associated with this account for the selected time frame. See the Amount column for the net dollar sum of these instructions. Click the CSV Export icon ( |

|

Status |

The status of the activity:

|

|

Amount |

The amount associated with the funds transfer or activity (both credit and debit). |

| Pending Amount | This amount includes pending net settled sales from the previous business day and any funding instruction activity sent without acknowledgement from the bank, and also any held funding instructions. |

|

Available Balance |

The available balance after the specific activity type has cleared for the selected date range or timespan and was added or subtracted from the Entering Balance. The top Available Balance amount indicated equals the amount in the Actual Balance field if viewing current date Account Details line items. |

|

Entering Balance |

The account balance at the start of the selected date range or timespan. |

For more detailed information on Dynamic Payout, see the PayFac Dynamic Payout document and the PayFac Dynamic Payout FAQ document.

Manual Adjustments

Manual adjustments are performed when we receive an unidentified funding instruction that is returned due to lateness (the time between the original ACH instruction and the return/reject by the RDFI). When that happens, the item won’t be on your daily Dynamic Payout Funding Reject Report by ACH Return Date SSR Report, and is denoted with '(M)' under their corresponding category in the Dynamic Payout Dashboard. For example, a manually-adjusted ACH exception is marked as: ACH Exception (M). These ACH returns are credited back to your FBO Settlement Account balance.

Held Funding Instructions

If an instruction is initially held after an Worldpay Compliance review, it is either released to be fully processed, or continued to be held with the funds while more research is completed. If the instruction is released by Worldpay Compliance, and is a FastAccess Funding instruction (FIFA), then it is processed in the normal manner via the debit rails on Worldpay Core/RAFT platform. The Issuer either approves or declines the instruction causing an update to the current status of the held instruction in reporting.

For declined FIFA transactions, the iQ Instruction Detail page includes the final response code. Clients only receive the original response/status via the cnpAPI response.

If the held instruction is an ACH-based instruction that was released by Worldpay Compliance, the instruction is processed as normal (overnight in ACH files) for settlement, or possibly rejected by the RDFI. This is reported next day or days after in your SSR reporting.