SEPA payments

SEPA (Single Euro Payments Area) is a European regulatory initiative to create a standard format for processing Euro transactions across 47 markets in Europe.

It harmonises the way Europeans make payments in these countries. By making bank transfer payments work to a common set of rules, the Single European Payments Area aims to make payments within the EU easier and more efficient.

You only need to provide a valid IBAN and SWIFT BIC to make a SEPA payment.

|

Template Field Name |

API Field Name |

CSV Field Name |

M/O |

Field Length |

Description |

|---|---|---|---|---|---|

|

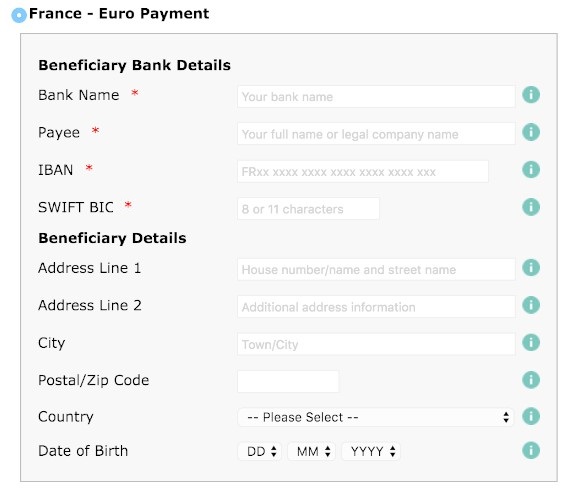

Bank Name |

BankName |

bank name |

Mandatory |

30 |

Name of the beneficiary (payee) bank |

|

Payee |

CustomerName |

payee |

Mandatory |

30 |

If the beneficiary (payee) is an individual, this should be their full name including both their first and last name (no initials) with a space in-between. If the beneficiary (payee) is a company, this should be the full company name. Failure to provide the full name could result in delays and potential rejection of your payment. This must consist of 2 words, separated by a space. |

|

IBAN |

IBAN |

iban |

Mandatory |

Varies by Country |

The International Bank Account Number (IBAN) is the account number of the beneficiary (payee). The format and length of the IBAN varies by country. See Appendix C: for a list by country. |

|

SWIFT BIC |

SWIFT |

swift |

Mandatory |

8 or 11 |

The SWIFT BIC is the Bank Identification Code of the beneficiary (payee) bank. It can be 8 or 11 alphanumeric characters. If SWIFT BIC is only 8 characters, do NOT infill to 11 characters by adding XXX. This causes the payment to be sent as an international payment instead of a domestic payment. |

|

Beneficiary Details |

|||||

|

Address Line 1 |

AddressLine1 |

B_AddressLine1 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) house number/name and street e.g. 1 Main Street |

|

Address Line 2 |

AddressLine2 |

B_AddressLine2 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) address e.g. apartment no., unit, studio |

|

City |

City |

B_City |

Optional |

35 |

Beneficiary’s city or town of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Postal/Zip Code |

Postcode |

B_Postcode |

Optional |

10 |

Beneficiary’s postal code or zip code of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Country |

CountryCode |

B_CountryCode |

Optional |

2 |

Beneficiary’s country of their residential (if payee is an individual) or registered (if payee is a company) address. If using the templates, select from the drop down or enter the 2 digit ISO 3166-1 standard country code in csv or API request. This can be found at the following link: |

|

Date of Birth |

DateOfBirth |

N/A |

Optional |

10 |

Beneficiary’s date of birth in DD/MM/YYYY format. If using the templates, select date, month and year from drop down or enter in DD/MM/YYYY format in API request (not available in csv request) |

SEPA Instant Payments

If you are set-up for both SEPA Credit and SEPA Instant route, then you should set the ‘fastPayment’ field as ‘Y’ (Yes) while initiating the payment instruction via the Merchant API or MAS portal. You can find the details on the field formatting in the following sections (depending on the request method): Standard CSV file, Extended CSV File, or payToBankAccountV3 API call.

SEPA Instant payment limit value is 100,000.00 EUR. If the merchant is set-up for both SEPA Credit and SEPA Instant route and the value of the payment instruction is above 100,000.00 EUR, the payment will be routed via SEPA Credit.

In some scenarios, payments rejected via SEPA Instant automatically retry via SEPA Credit. Possible examples of this are:

-

The rejection of the SEPA Instant payment occurs at the scheme level due to technical issues

-

The beneficiary account is not enabled for SEPA Instant, despite the beneficiary PSP being an Instant SEPA scheme participant

SEPA compliance

Compliance with the SEPA format for Euro transfers is a mandatory requirement for Worldpay AP. To process payment instructions to recipients in these countries and territories we have to comply with it.

These instructions are referred to as SEPA Credit Transfers (SCT). Through the system integrations we have with our partner banks we hope to have removed the complexities of this for you.

The information in this section describes the recipient bank details that we must capture to execute Euro (EUR) payments to the countries and territories shown below.

Some of the countries, whilst they are in the SEPA region, do not use the Euro as their national currency. If you are making payments to these countries in local currencies you should capture the recipient bank information outlined in Domestic payments

Principal countries in SEPA (for EUR transfers)

Euro area countries

|

Country |

ISO code |

Local currency |

|---|---|---|

|

Austria |

AT |

EUR |

|

Belgium |

BE |

EUR |

|

Cyprus |

CY |

EUR |

|

Estonia |

EE |

EUR |

|

Finland |

FI |

EUR |

|

France |

FR |

EUR |

|

Germany |

DE |

EUR |

|

Greece |

GR |

EUR |

|

Ireland |

IE |

EUR |

|

Italy |

IT |

EUR |

|

Latvia |

LV |

EUR |

|

Lithuania |

LT |

EUR |

|

Luxembourg |

LU |

EUR |

|

Malta |

MT |

EUR |

|

Netherlands |

NL |

EUR |

|

Portugal |

PT |

EUR |

|

Slovakia |

SK |

EUR |

|

Slovenia |

SI |

EUR |

|

Spain |

ES |

EUR |

Non-Euro countries

|

Country |

ISO code |

Local currency |

|---|---|---|

|

Bulgaria |

BG |

BGN |

|

Croatia |

HR |

HRK |

|

Czech Republic |

CZ |

CZK |

|

Denmark |

DK |

DKK |

|

Hungary |

HU |

HUF |

|

Poland |

PL |

PLN |

|

Romania |

RO |

RON |

|

Sweden |

SE |

SEK |

|

United Kingdom |

GB |

GBP |

Non-EU countries

|

Country |

ISO code |

Local currency |

|---|---|---|

|

Andorra |

AD |

EUR |

|

Iceland |

IS |

ISK |

|

Liechtenstein |

LI |

CHF |

|

Monaco |

MC |

EUR |

|

Norway |

NO |

NOK |

|

San Marino |

SM |

EUR |

|

Switzerland |

CH |

CHF |

Other territories in SEPA

Payments in Euros to the following territories are also classified as SEPA credit transfers, and require the same recipient bank information to be captured:

-

Aland Islands (FI)

-

Azores (PT)

-

Canary Islands (ES)

-

French Guiana (GF)

-

Gibraltar (GR)

-

Guadeloupe (GP)

-

Madeira (PT)

-

Martinique (MQ)

-

Mayotte (YT)

-

Reunion (RE)

-

St Barthelemy (BL)

-

Saint Martin (MF)

-

Saint Pierre & Miquelon (PM)