International payments

Where a domestic paymentis not possible, either because Worldpay does not have a local bank account or because the currency is not local to the country, then you can initiate an international payment. Worldpay uses a global banking partner to make these payments.

With the exception of any sanctioned countries and subject to our global banking partner’s policies, we can make payments to any country worldwide in the following 21 currencies:

|

International payment currencies |

||

|---|---|---|

|

AUD Australian Dollar |

CAD Canadian Dollar |

CHF Swiss Franc |

|

CZK Czech Koruna |

DKK Danish Krone |

EUR Euro |

|

GBP Great British Pound |

HKD Hong Kong Dollar |

HUF Hungarian Forint |

|

ILS Israeli Shekel |

JPY Japanese Yen |

MXN Mexican Peso |

|

NOK Norwegian Krone |

NZD New Zealand Dollar |

PLN Polish Zloty |

|

RON Romanian Leu |

SEK Swedish Krona |

SGD Singapore Dollar |

|

THB Thai Baht |

USD United States Dollar |

ZAR South African Rand |

Although the information required to make these payments is less specific than for domestic payments, there are some different templates.

The information contained in all the International templates is summarised in Templates by Country.

JPY is a zero decimal currency. The pay-out amount will be rounded up if submitted with decimals.

Required information

BIC and BBAN template

The BIC and BBAN template requires the SWIFT BIC (8 or 11 character Bank Indicator Code) and the BBAN (Basic Bank Account Number) as mandatory fields. The countries that are able to use this template for international payments are:

|

Countries using the BIC and BBAN template |

||

|---|---|---|

|

Argentina |

Azerbaijan |

Bosnia and Herzegovina |

|

Cameroon |

Canada |

Cape Verde |

|

Chile |

Colombia |

Costa Rica |

|

India |

Isle of Man |

Japan |

|

Korea, Republic of |

Kuwait |

Kyrgyzstan |

|

Lebanon |

Macedonia, the former Yugoslav Republic of |

Malaysia |

|

Mali |

Mauritania |

Mauritius |

|

Mexico |

Moldova, Republic of |

Montenegro |

|

Mozambique |

New Caledonia |

New Zealand |

|

Peru |

San Marino |

Saudi Arabia |

|

Senegal |

Singapore |

South Africa |

|

Thailand |

Ukraine |

Uruguay |

|

Template Field Name |

API Field Name |

CSV Field Name |

Mandatory/Optional |

Field Length |

Description |

|---|---|---|---|---|---|

|

Bank Name |

BankName |

bank name |

Mandatory |

50 |

Name of the beneficiary (payee) bank |

|

Payee |

CustomerName |

payee |

Mandatory |

50 |

If the beneficiary (payee) is an individual, this should be their full name including both their first and last name (no initials) with a space in-between. If the beneficiary (payee) is a company, this should be the full company name. Failure to provide the full name could result in delays and potential rejection of your payment. This must consist of 2 words, separated by a space. |

|

Account Number |

BankAccountNumber |

account number |

Mandatory |

Varies by country |

Beneficiary account number (BBAN) |

|

Bank Code |

BankCode |

bank code |

Optional |

Varies by country |

|

|

Branch Code |

BranchCode |

branch code |

Optional |

Varies by country |

|

|

SWIFT BIC |

SWIFT |

swift |

Mandatory |

8/11 |

The SWIFT BIC is the Bank Identification Code of the beneficiary (payee) bank. It can be 8 or 11 alphanumeric characters in the following format: xxxxAAxx or xxxxAAxxxxx where AA is the two character ISO country code. A full list of ISO codes can be found here. Worldpay does not take responsibility for an external website's operation or content. |

|

Beneficiary Details |

|||||

|

Address Line 1 |

AddressLine1 |

B_AddressLine1 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) house number/name and street e.g. 1 Main Street |

|

Address Line 2 |

AddressLine2 |

B_AddressLine2 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) address e.g. apartment no., unit, studio |

|

City |

City |

B_City |

Optional |

35 |

Beneficiary’s city or town of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Postal/Zip Code |

Postcode |

B_Postcode |

Optional |

10 |

Beneficiary’s postal code or zip code of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Country |

CountryCode |

B_CountryCode |

Optional/Mandatory (if any of the optional Beneficiary address details are provided) |

2 |

Beneficiary’s country of their residential (if payee is an individual) or registered (if payee is a company) address. If using the templates, select from the drop down or enter the 2 digit ISO 3166-1 standard country code in csv or API request. This can be found at the following link: |

|

Date of Birth |

DateOfBirth |

N/A |

Optional |

10 |

Beneficiary’s date of birth in DD/MM/YYYY format. If using the templates, select date, month and year from drop down or enter in DD/MM/YYYY format in API request (not available in csv request) |

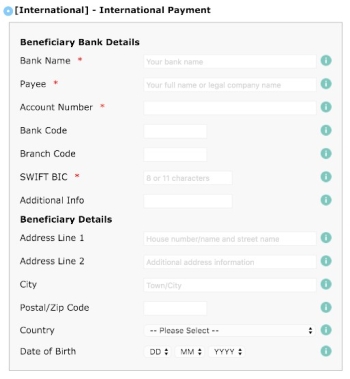

Additionally, the BIC and BBAN template is used for all other countries that are not listed with a specific template. This is an example of a generic template:

BIC and IBAN template

The BIC and IBAN template requires the SWIFT BIC (8 or 11 character Bank Indicator Code) and the IBAN (International Bank Account Number) as mandatory fields.

Where a BBAN and IBAN template both exist, it is recommended to use the IBAN template.

The countries that are able to use this template for international payments are:

|

Countries using the BIC and IBAN template |

||

|---|---|---|

|

Åland Islands |

Albania |

Andorra |

|

Angola |

Austria |

Azerbaijan |

|

Bahrain |

Belgium |

Bosnia and Herzegovina |

|

Brazil |

Bulgaria |

Cameroon |

|

Cape Verde |

Costa Rica |

Croatia |

|

Cyprus |

Czech Republic |

Denmark |

|

Estonia |

Faroe Islands |

Finland |

|

France |

French Guiana |

Georgia |

|

Germany |

Gibraltar |

Greece |

|

Greenland |

Guadeloupe |

Hungary |

|

Iceland |

Ireland |

Isle of Man |

|

Israel |

Italy |

Jordan |

|

Kuwait |

Kyrgyzstan |

Latvia |

|

Lebanon |

Liechtenstein |

Lithuania |

|

Luxembourg |

Macedonia, the former Yugoslav Republic of |

Mali |

|

Malta |

Martinique |

Mauritania |

|

Mauritius |

Mayotte |

Moldova, Republic of |

|

Monaco |

Montenegro |

Mozambique |

|

Netherlands |

New Caledonia |

Norway |

|

Pakistan |

Poland |

Portugal |

|

Qatar |

Réunion |

Romania |

|

Saint Barthélemy |

Saint Martin (French part) |

Saint Pierre and Miquelon |

|

San Marino |

Saudi Arabia |

Senegal |

|

Serbia |

Slovakia |

Slovenia |

|

Spain |

Sweden |

Switzerland |

|

Tunisia |

Turkey |

Ukraine |

|

United Arab Emirates |

United Kingdom |

|

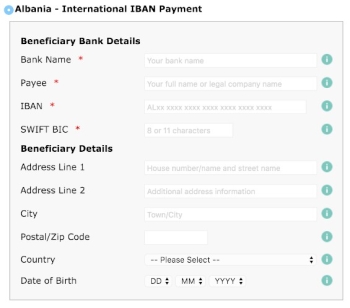

This is an example of the template:

|

Template Field Name |

API Field Name |

CSV Field Name |

Mandatory/Optional |

Field Length |

Description |

|---|---|---|---|---|---|

|

Bank Name |

BankName |

bank name |

Mandatory |

50 |

Name of the beneficiary (payee) bank |

|

Payee |

CustomerName |

payee |

Mandatory |

50 |

If the beneficiary (payee) is an individual, this should be their full name including both their first and last name (no initials) with a space in- between. If the beneficiary (payee) is a company, this should be the full company name. Failure to provide the full name could result in delays and potential rejection of your payment. This must consist of 2 words, separated by a space. |

|

IBAN |

IBAN |

iban |

Mandatory |

The International Bank Account Number (IBAN) is the account number of the beneficiary (payee). The format and length of the IBAN varies by country. See IBAN and BIC formats by Country for list. |

|

|

SWIFT BIC |

SWIFT |

swift |

Mandatory |

8/11 |

The SWIFT BIC is the Bank Identification Code of the beneficiary (payee) bank. It can be 8 or 11 alphanumeric characters in the following format: xxxxAAxx or xxxxAAxxxxx where AA is the two character ISO country code. A full list of ISO codes can be found here. Worldpay does not take responsibility for an external website's operation or content. |

|

Beneficiary Details |

|||||

|

Address Line 1 |

AddressLine1 |

B_AddressLine1 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) house number/name and street e.g. 1 Main Street |

|

Address Line 2 |

AddressLine2 |

B_AddressLine2 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) address e.g. apartment no., unit, studio |

|

City |

City |

B_City |

Optional |

35 |

Beneficiary’s city or town of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Postal/Zip Code |

Postcode |

B_Postcode |

Optional |

10 |

Beneficiary’s postal code or zip code of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Country |

CountryCode |

B_CountryCode |

Optional/Mandatory (if any of the optional Beneficiary address details are provided) |

2 |

Beneficiary’s country of their residential (if payee is an individual) or registered (if payee is a company) address. If using the templates, select from the drop down or enter the 2 digit ISO 3166-1 standard country code in csv or API request. This can be found at the following link: |

|

Date of Birth |

DateOfBirth |

N/A |

Optional |

10 |

Beneficiary’s date of birth in DD/MM/YYYY format. If using the templates, select date, month and year from drop down or enter in DD/MM/YYYY format in API request (not available in csv request) |

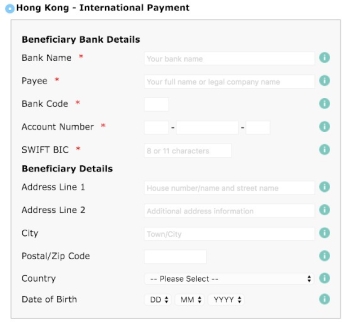

BIC, Bank Code and BBAN template

The BIC, Bank Code and BBAN template requires the SWIFT BIC (8 or 11 character Bank Indicator Code), Bank Code and the BBAN (Basic Bank Account Number , otherwise known as the account number) as mandatory fields. Only payments to Hong Kong need this template.

|

Template Field Name |

API Field Name |

CSV Field Name |

Mandatory/Optional |

Field Length |

Description |

|---|---|---|---|---|---|

|

Bank Name |

BankName |

bank name |

Mandatory |

50 |

Name of the beneficiary (payee) bank. Select from the drop down or select ‘Other’ and type in the bank name. |

|

Payee |

CustomerName |

payee |

Mandatory |

50 |

If the beneficiary (payee) is an individual, this should be their full name including both their first and last name (no initials) with a space in-between. If the beneficiary (payee) is a company, this should be the full company name. Failure to provide the full name could result in delays and potential rejection of your payment. This must consist of 2 words, separated by a space. |

|

Bank Code |

BankCode |

bank code |

Mandatory |

4 |

|

|

Account Number |

BankAccountNumber |

account number |

Mandatory |

3+6+3 |

Branch Code and Account Number comprised of: 3 digits = branch code 6+3 digits = account number |

|

SWIFT BIC |

SWIFT |

swift |

Mandatory |

8/11 |

The SWIFT BIC is the Bank Identification Code of the beneficiary (payee) bank. The SWIFT BIC can be 8 or 11 alphanumeric characters in the following format: xxxxHKxx or xxxxHKxxxxx |

|

Beneficiary Details |

|||||

|

Address Line 1 |

AddressLine1 |

B_AddressLine1 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) house number/name and street e.g. 1 Main Street |

|

Address Line 2 |

AddressLine2 |

B_AddressLine2 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) address e.g. apartment no., unit, studio |

|

City |

City |

B_City |

Optional |

35 |

Beneficiary’s city or town of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Postal/Zip Code |

Postcode |

B_Postcode |

Optional |

10 |

Beneficiary’s postal code or zip code of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Country |

CountryCode |

B_CountryCode |

Optional/Mandatory (if any of the optional Beneficiary address details are provided) |

2 |

Beneficiary’s country of their residential (if payee is an individual) or registered (if payee is a company) address. If using the templates, select from the drop down or enter the 2 digit ISO 3166-1 standard country code in csv or API request. This can be found at the following link: |

|

Date of Birth |

DateOfBirth |

N/A |

Optional |

10 |

Beneficiary’s date of birth in DD/MM/YYYY format. If using the templates, select date, month and year from drop down or enter in DD/MM/YYYY format in API request (not available in csv request) |

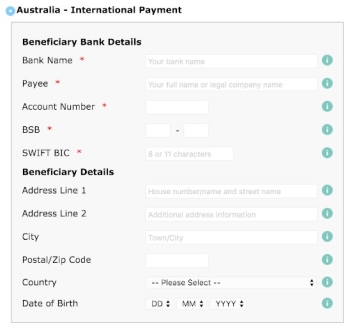

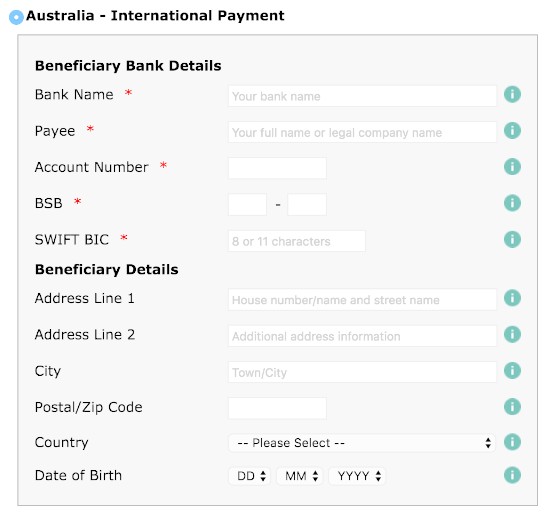

BIC, BSB and BBAN template

The BIC, BSB and BBAN template requires the SWIFT BIC (8 or 11 character Bank Indicator Code), BSB (Bank State Branch Code) and the BBAN (Basic Bank Account Number , otherwise known as the account number) as mandatory fields. Only payments to Australia need this template.

|

Template Field Name |

API Field Name |

CSV Field Name |

Mandatory/Optional |

Field Length |

Description |

|---|---|---|---|---|---|

|

Bank Name |

BankName |

bank name |

Mandatory |

30 |

Name of the beneficiary (payee) bank |

|

Payee |

CustomerName |

payee |

Mandatory |

50 |

If the beneficiary (payee) is an individual, this should be their full name including both their first and last name (no initials) with a space in-between. If the beneficiary (payee) is a company, this should be the full company name. Failure to provide the full name could result in delays and potential rejection of your payment. This must consist of 2 words, separated by a space. |

|

Account Number |

BankAccountNumber |

account number |

Mandatory |

5-9 |

Account number of the beneficiary. Can be between 5 and 9 digits. |

|

BSB |

BankCode |

bank code |

Mandatory |

3+3 |

BSB (Bank State Branch Code) is comprised of 6 digits representing the bank and branch as follows:

For help finding the BSB for a particular bank, please click this link. Worldpay does not take responsibility for an external website's operation or content. |

|

SWIFT BIC |

SWIFT |

swift |

Mandatory |

8/11 |

The SWIFT BIC is the Bank Identification Code of the beneficiary (payee) bank. The SWIFT BIC can be 8 or 11 alphanumeric characters in the following format: xxxxAUxx or xxxxAUxxxxx |

|

Beneficiary Details |

|||||

|

Address Line 1 |

AddressLine1 |

B_AddressLine1 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) house number/name and street e.g. 1 Main Street |

|

Address Line 2 |

AddressLine2 |

B_AddressLine2 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) address e.g. apartment no., unit, studio |

|

City |

City |

B_City |

Optional |

35 |

Beneficiary’s city or town of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Postal/Zip Code |

Postcode |

B_Postcode |

Optional |

10 |

Beneficiary’s postal code or zip code of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Country |

CountryCode |

B_CountryCode |

Optional/Mandatory (if any of the optional Beneficiary address details are provided) |

2 |

Beneficiary’s country of their residential (if payee is an individual) or registered (if payee is a company) address. If using the templates, select from the drop down or enter the 2 digit ISO 3166-1 standard country code in csv or API request. This can be found at the following link: |

|

Date of Birth |

DateOfBirth |

N/A |

Optional |

10 |

Beneficiary’s date of birth in DD/MM/YYYY format. If using the templates, select date, month and year from drop down or enter in DD/MM/YYYY format in API request (not available in csv request) |

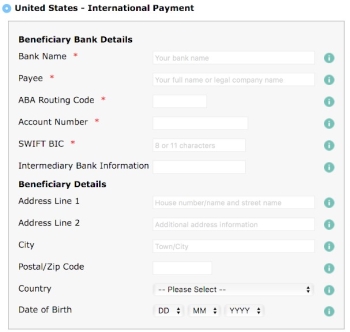

BIC, Routing Code and BBAN template

The BIC, Routing Code and BBAN template requires the SWIFT BIC (8 or 11 character Bank Indicator Code), Routing Code and the BBAN (Basic Bank Account Number otherwise known as the account number) as mandatory fields. Only payments to the US need this template.

|

Template Field Name |

API Field Name |

CSV Field Name |

Mandatory/Optional |

Field Length |

Description |

|---|---|---|---|---|---|

|

Bank Name |

BankName |

bank name |

Mandatory |

30 |

Name of the beneficiary (payee) bank |

|

Payee |

CustomerName |

payee |

Mandatory |

50 |

If the beneficiary (payee) is an individual, this should be their full name including both their first and last name (no initials) with a space in-between. If the beneficiary (payee) is a company, this should be the full company name. Failure to provide the full name could result in delays and potential rejection of your payment. This must consist of 2 words, separated by a space. |

|

ABA Routing Code |

BankCode |

bank code |

Mandatory |

9 |

Numeric number that identifies the beneficiary bank |

|

Account Number |

BankAccountNumber |

account number |

Mandatory |

9-17 |

Can be up to 17 digits |

|

SWIFT BIC |

SWIFT |

swift |

Mandatory |

8/11 |

The SWIFT BIC is the Bank Identification Code of the beneficiary (payee) bank. The SWIFT BIC can be 8 or 11 alphanumeric characters in the following format: xxxxUSxx or xxxxUSxxxxx |

|

Beneficiary Details |

|||||

|

Address Line 1 |

AddressLine1 |

B_AddressLine1 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) house number/name and street e.g. 1 Main Street |

|

Address Line 2 |

AddressLine2 |

B_AddressLine2 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) address e.g. apartment no., unit, studio |

|

City |

City |

B_City |

Optional |

35 |

Beneficiary’s city or town of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Postal/Zip Code |

Postcode |

B_Postcode |

Optional |

10 |

Beneficiary’s postal code or zip code of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Country |

CountryCode |

B_CountryCode |

Optional/Mandatory (if any of the optional Beneficiary address details are provided) |

2 |

Beneficiary’s country of their residential (if payee is an individual) or registered (if payee is a company) address. If using the templates, select from the drop down or enter the 2 digit ISO 3166-1 standard country code in csv or API request. This can be found at the following link: |

|

Date of Birth |

DateOfBirth |

N/A |

Optional |

10 |

Beneficiary’s date of birth in DD/MM/YYYY format. If using the templates, select date, month and year from drop down or enter in DD/MM/YYYY format in API request (not available in csv request) |

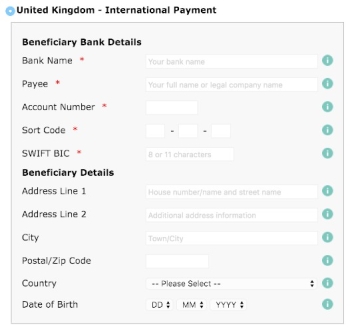

BIC, Sort Code and BBAN template

The BIC, Sort Code and BBAN template requires the SWIFT BIC (8 or 11 character Bank Indicator Code), Sort Code and the BBAN (Basic Bank Account Number, otherwise known as the account number) as mandatory fields. Only payments to the UK, Guernsey and Jersey need this template.

|

Template Field Name |

API Field Name |

CSV Field Name |

Mandatory/Optional |

Field Length |

Description |

|---|---|---|---|---|---|

|

Bank Name |

BankName |

bank name |

Mandatory |

50 |

Name of the beneficiary (payee) bank |

|

Payee |

CustomerName |

payee |

Mandatory |

50 |

If the beneficiary (payee) is an individual, this should be their full name including both their first and last name (no initials) with a space in-between. If the beneficiary (payee) is a company, this should be the full company name. Failure to provide the full name could result in delays and potential rejection of your payment. This must consist of 2 words, separated by a space. |

|

Account Number |

BankAccountNumber |

account number |

Mandatory |

8 |

|

|

Sort Code |

BankCode |

bank code |

Mandatory |

2+2+2 |

Made up of the bank code and branch code. The first 2 digits are the bank code with the last 4 being the branch code. |

|

SWIFT BIC |

SWIFT |

swift |

Mandatory |

8/11 |

The SWIFT BIC is the Bank Identification Code of the beneficiary (payee) bank. The SWIFT BIC can be 8 or 11 alphanumeric characters in the following format: xxxxGBxx or xxxxGBxxxxx |

|

Beneficiary Details |

|||||

|

Address Line 1 |

AddressLine1 |

B_AddressLine1 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) house number/name and street e.g. 1 Main Street |

|

Address Line 2 |

AddressLine2 |

B_AddressLine2 |

Optional |

35 |

Beneficiary’s residential (if payee is an individual) or registered (if payee is a company) address e.g. apartment no., unit, studio |

|

City |

City |

B_City |

Optional |

35 |

Beneficiary’s city or town of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Postal/Zip Code |

Postcode |

B_Postcode |

Optional |

10 |

Beneficiary’s postal code or zip code of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Country |

CountryCode |

B_CountryCode |

Optional/Mandatory (if any of the optional Beneficiary address details are provided) |

2 |

Beneficiary’s country of their residential (if payee is an individual) or registered (if payee is a company) address. If using the templates, select from the drop down or enter the 2 digit ISO 3166-1 standard country code in csv or API request. This can be found at the following link: |

|

Date of Birth |

DateOfBirth |

N/A |

Optional |

10 |

Beneficiary’s date of birth in DD/MM/YYYY format. If using the templates, select date, month and year from drop down or enter in DD/MM/YYYY format in API request (not available in csv request) |

Additional Information

Some countries require additional information to be included on the payment in line with regulations in that country. Below are the countries that require additional information and details on where to include this:

Australia

|

Template Field Name |

API Field Name |

CSV Field Name |

Mandatory or optional |

Field Length |

Description |

|---|---|---|---|---|---|

|

Bank Name |

BankName |

bankName |

Mandatory |

30 |

Name of the beneficiary (payee) bank |

|

Payee |

CustomerName |

payee |

Mandatory |

30 |

If the beneficiary (payee) is an individual, this should be their full name including both their first and last name (no initials) with a space in-between. If the beneficiary (payee) is a company, this should be the full company name. Failure to provide the full name could result in delays and potential rejection of your payment. This must consist of 2 words, separated by a space. |

|

Account Number |

BankAccountNumber |

accountNumber |

Mandatory |

5-20 |

Beneficiary (payee) account number. This can be between 5 and 20 digits long. |

|

BSB |

BankCode |

bank code |

Mandatory |

6 (3+3) |

BSB (Bank State Branch Code) is comprised of 6 digits representing the bank and branch as follows:

|

|

SWIFT / BIC |

SWIFT |

swift |

Mandatory |

8 / 11 |

The SWIFT BIC is the Bank Identification Code of the beneficiary (payee) bank. It can be 8 or 11 alphanumeric characters in the following format: xxxxAUxx or xxxxAUxxxxx |

|

Beneficiary Details |

|||||

|

Address Line 1 |

AddressLine1 |

B_AddressLine1 |

Mandatory |

35 |

Beneficiary's residential (if payee is an individual) or registered (if payee is a company) house number/name and street e.g. 1 Main Street |

|

Address Line 2 |

AddressLine2 |

B_AddressLine2 |

Optional |

35 |

Beneficiary's residential (if payee is an individual) or registered (if payee is a company) address e.g. apartment no., unit, studio |

|

City |

City |

B_City |

Mandatory |

35 |

Beneficiary's city or town of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Postal / Zip Code |

Postcode |

B_Postcode |

Mandatory |

10 |

Beneficiary's postal code or zip code of their residential (if payee is an individual) or registered (if payee is a company) address |

|

State |

State |

B_State |

Mandatory |

35 |

Beneficiary's state of their residential (if payee is an individual) or registered (if payee is a company) address. Must be:

|

|

Country |

CountryCode |

B_CountryCode |

Mandatory |

2 |

Beneficiary's country of their residential (if payee is an individual) or registered (if payee is a company) address. If using the templates, select from the drop down or enter the 2 digit ISO 3166-1 standard country code in csv or API request. This can be found at the following link: |

|

Date of Birth |

DateofBirth |

N/A |

Optional |

10 |

Beneficiary's date of birth in DD/MM/YYYY format. If using the templates, select date, month and year from drop down or enter in DD/MM/YYYY format in API request (not available in csv request) |

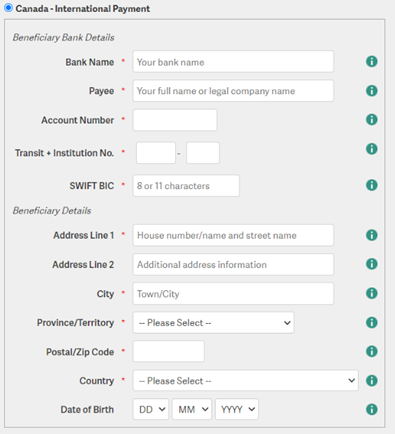

Canada

|

Template Field Name |

API Field Name |

CSV Field Name |

Mandatory or optional |

Field Length |

Description |

|---|---|---|---|---|---|

|

Bank Name |

BankName |

bank name |

Mandatory |

50 |

Name of the beneficiary (payee) bank. If using the templates, select from the drop down or select ‘other’ and type in the bank name. |

|

Payee |

CustomerName |

payee |

Mandatory |

50 |

If the beneficiary (payee) is an individual, this should be their full name including both their first and last name (no initials) with a space in-between. If the beneficiary (payee) is a company, this should be the full company name. Failure to provide the full name could result in delays and potential rejection of your payment. This must consist of 2 words, separated by a space. |

|

Account Number |

BankAccountNumber |

account number |

Mandatory |

5-12 |

Account number of the beneficiary. Can be between 5 and 12 digits, but is usually greater than 7 digits in length. On most bank cheques, the account number is after the Branch Transit and Financial Institution numbers. |

|

Branch Transit Number |

BranchCode |

branch code |

Mandatory |

5 |

Uniquely identifies the beneficiary’s Canadian Bank branch. This can be found on the beneficiary’s online banking or a cheque. A void cheque can be created through most online banking portals. See Additional Information below. |

|

Financial Institution Number |

BankCode |

bank code |

Mandatory |

3 |

Identifies the beneficiary’s Canadian Bank. This is always 3 digits in length, and can be found on the beneficiary’s online banking or a cheque. A void cheque can be created through most online banking portals. See Additional Information below. |

|

SWIFT / BIC |

SWIFT |

swift |

Mandatory |

8 / 11 |

The SWIFT BIC is the Bank Identification Code of the beneficiary (payee) bank. It can be 8 or 11 alphanumeric characters in the following format: If the SWIFT BIC is only 8 characters, do NOT infill to 11 characters by adding XXX. This causes the payment to be sent as an international payment instead of a domestic payment. |

|

Beneficiary Details |

|||||

|

Address Line 1 |

AddressLine1 |

B_AddressLine1 |

Mandatory |

35 |

Beneficiary's residential (if payee is an individual) or registered (if payee is a company) house number/name and street e.g. 1 Main Street |

|

Address Line 2 |

AddressLine2 |

B_AddressLine2 |

Optional |

35 |

Beneficiary's residential (if payee is an individual) or registered (if payee is a company) address e.g. apartment no., unit, studio |

|

City |

City |

B_City |

Mandatory |

35 |

Beneficiary's city or town of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Postal / Zip Code |

Postcode |

B_Postcode |

Mandatory |

10 |

Beneficiary's postal code or zip code of their residential (if payee is an individual) or registered (if payee is a company) address |

|

Country |

CountryCode |

B_CountryCode |

Mandatory |

2 |

Beneficiary's country of their residential (if payee is an individual) or registered (if payee is a company) address. If using the templates, select from the drop down or enter the 2-digit ISO 3166-1 standard country code in csv or API request. This can be found at the following link: |

|

Date of Birth |

DateofBirth |

N/A |

Optional |

10 |

Beneficiary's date of birth in DD/MM/YYYY format. If using the templates, select date, month and year from drop down or enter in DD/MM/YYYY format in API request (not available in csv request) |

Additional Information

A beneficiary’s Branch Transit Number and Financial Institution Number sometimes appears combined into a Routing Number.

The Routing Number format is 0XXXYYYYY consisting of:

• 0 – Leading zero. Do not include in Push to Account instruction.

• XXX – Financial Institution Number

• YYYYY – Branch Transit Number

India

Payments to India in INR require the following information to be included on the payment instruction for them to be accepted:

-

Remitter Name and Address – Your name and address must be included on the payment. This information must be stored within our system. In order to confirm your correct details are in the system, please contact your Relationship Manager or Corporate Support Manager

-

Purpose of Payment – the purpose of your payment must be included on the payment. This can be included in the PaymentDescription field on the API (v3 only).

For further information on how to format your payments to India, please contact your Relationship Manager or Corporate Support Manager.

Jordan

Payments to Jordan require the following information to be included on the payment instruction for them to be accepted:

-

Purpose of Payment and Purpose of Payment Code– the purpose of payment and purpose of payment code must be included on the payment. This must be taken from the list in Appendix D.

-

The purpose of payment and purpose of payment code can be included in the PaymentDescription field on the API (v3 only).

For further information on how to format your payments to Jordan, please contact your Relationship Manager or Corporate Support Manager.

United Arab Emirates (UAE)

Payments to the UAE requires you to include the following information on the payment instruction for them to be accepted:

-

Purpose of Payment Code – You must include a purpose of payment code in the payment. You can include this in the PaymentDescription field on the API (v3 only).

For further information on how to format your payments to the UAE, please contact your Relationship Manager or Corporate Support Manager.