Instruction Processing

RealNet Payments LLC: 11000 W Lake Park Drive, Milwaukee, WI 53224 (800)729.8787.

Privacy statement found here.

What is the maximum number of instructions I can submit in a single Batch?

Although the hard limit for any single Batch file is 100,000 instructions, the recommended number of instructions in a single Batch file is 20,000. If you need to submit a larger number of instructions, create multiple Batch files within the Session file. A Session file, which is a group of Batch files, must not exceed 1,000,000 instructions across all Batches.

For example, if you wish to submit 200,000 funding instructions, Worldpay recommends for you to create a Session file containing 10 Batches of 20,000 instructions each.

If I submit multiple instruction Batch files in a Session and one of the Batches has an over balance issue, do you reject all the Batches?

No. Worldpay rejects only the Batch file with the issue. The processing of instructions in the other Batch files occurs normally.

How do I know that the submitted Batch file was received by Worldpay?

We produce an acknowledgment file shortly after receiving the Batch file. The timing depends upon the size of the submitted file, larger files take longer. To retrieve the acknowledgment file do the following:

- Open your FTP connection to the Worldpay outbound directory.

- Locate the response file, which will have the same name as the file you submitted. If the response file has a .prg extension, it is still transferring. The extension changes to .asc when the transfer to the outbound directory completes.

- Retrieve the response file.

What is my cutoff time for sending funding instructions?

The cutoff time for submission of funding instructions is 7:00PM ET, except for those marked for same day funding. The cutoff time for same day funding is 11:00 AM ET.

What is my cutoff time for submission of payment transactions for next day settlement into my FBO Settlement account?

Generally, the processing cutoff time for next day settlement is 10:00PM ET for Worldpay Core (i.e., submit EMD file by 10:00 ET), and 10:00 PM ET for the eComm platform, unless you utilize next-day Direct Debit, which changes the cut-off for all deposits to 8:00PM ET. Your contracted time may differ.

Assuming I sent multiple funding instructions to various accounts on any given day, do you roll-up the transactions to reduce the number and if so, how does the roll-up occur?

We roll-up all funding instructions to/from your Operating account (FIPC/FIPD) for given day into a single ACH transaction. Similarly, we roll-up funding instructions to/from your Reserve account (FIRC/FIRD). For Vendor instructions (FIVC), we roll-up the instructions based upon the account number transferred to/from, not the vendor.

We never roll-up instructions related to sub-merchant accounts or FastAccess Funding instructions. Each instruction translates to an ACH transaction.

How do I find out if my funding instructions have failed or been returned?

In SSR, Worldpay generates a daily report, the Funding Reject Report by ACH Return Date report, which provides details about failed/returned instructions, including the reasons for the failures/returns. The report includes the return date, the original date, and the attempted funds transfer date. The return date is the date the issuing bank processed the funding instruction. The original date is the original date of the transaction (i.e., Batch post date). The Attempted Funds Transfer Date is the date that Bank attempted to settle funds. Please refer to the Worldpay eComm Scheduled Secure Report Reference Guide for additional information.

You can also access information about failed/returned funding instructions in the eCommerce iQ. Please review the next question.

If all of your funding instructions failed or you submitted your funding instructions after the 7:00 PM cut-off, your next day Funding Instruction Confirmation Report will be generated empty (i.e., headers, but with no data).

If your funding instructions pass the front-end validation, but fail the back-end validation, we will notify your company's First Line Support Contacts.

Where, in iQ, can I find information about failed or returned funding instructions?

iQ shows the associated payment stream for an instruction. In the case of a failed/returned funding instruction, he Instruction Detail page displays the status, reason code, and reason message. You can access the Instruction Detail page in iQ from either the Batch Detail Report or Instruction Search results. The return appears as an associated transaction for the returned instruction. You cannot search for the return itself.

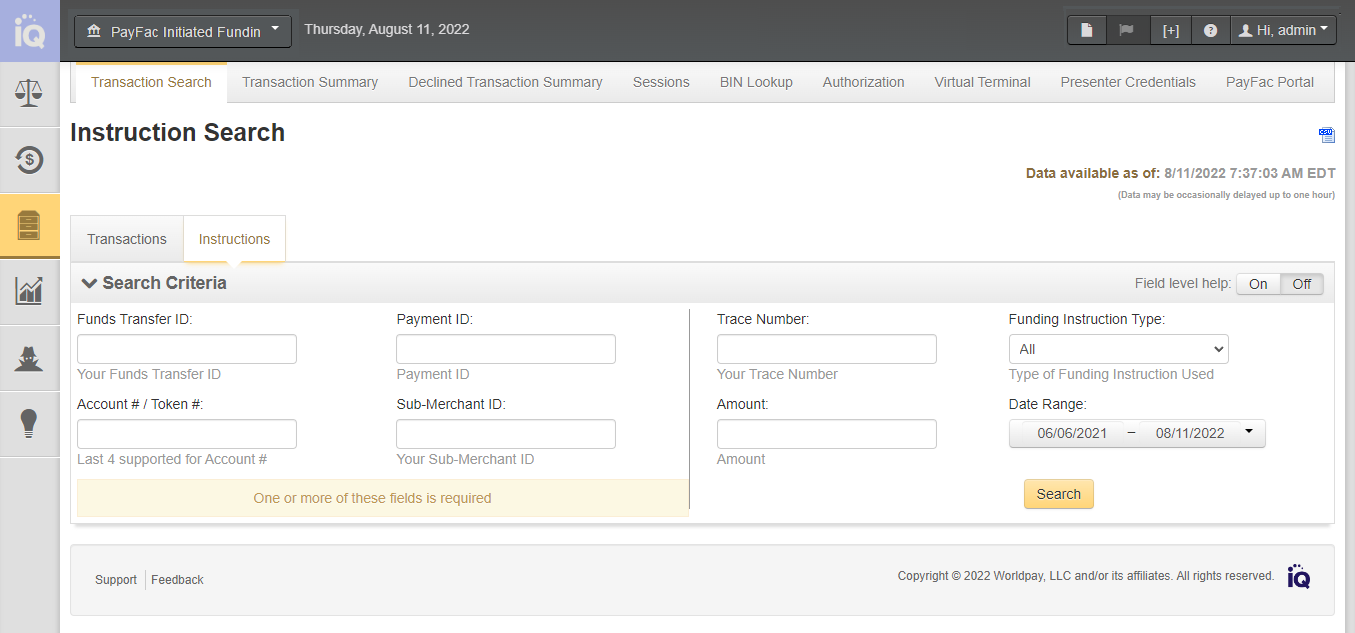

Instruction Search enables Payment Facilitators using Dynamic Payout to find information on sub-merchant funding instructions processed by Worldpay, including credits and debits for Payment Facilitator, sub-merchant, reserve, and vendor (credit only) accounts. After clicking the Search button, the results panel appears below the Instruction Search. The Instruction Search Results list displays a hypertext link for each Worldpay Payment ID matching your search criteria. To navigate to the associated Instruction Detail Screen, click Worldpay Payment ID. The Instruction Detail screens display comprehensive information about a single funding instruction transaction.

The Batch Detail report provides a detailed breakdown of transactions contained within a batch, and includes a summary of batches in the top panel as well as a detailed data table below. From the same report window, you can click a link to navigate to the Batch Detail Screen and then click a link to navigate to the Instruction Detail Screen for further details on a Dynamic Payout funding instruction.

How do I find out if Worldpay received my funding instructions successfully?

The funding instruction response includes confirmation. Successfully received instructions contain "Approved" in the message element of the response. Please refer to the Worldpay eComm cnpAPI Reference Guide for additional information.

In iQ, you can also determine if your funding instructions were received successfully via the Session Activity report. The Session Activity report provides a real-time view of the data you present for processing, to ensure that the data has been transmitted correctly to Worldpay. From the Session Activity report, you can monitor sessions in different states of completion for the selected date range (Sessions Started, Sessions with Activity, and Sessions Ended), including a summary of all batches, transactions in the batch and a table detailing the batches contained in the selected session type. The Batch Detail report provides a detailed breakdown of transactions contained within a batch. From within each of the tabs in the Batch Detail report, you can click a link to navigate to the Instruction Detail Screen for details on a PayFac Dynamic Payout funding instruction. Please refer to the Worldpay eCommerce iQ Reporting and Analytics User Guide for additional information.

The Funding Instruction Confirmation Report includes all successfully delivered funding instructions. This report shows all Funding Instruction delivered successfully to the bank on the previous business day. These funds should settle to the accounts on the current business day. Please refer to the Worldpay eComm Secured Scheduled Report Reference Guide for additional information.

Do you perform dupe checks on funding instructions?

Dupe checking for funding instructions takes place at the batch level. That is, batches submitted and accepted on the same day with the same totals and counts will fail dupe checking and be rejected. If you resubmit a previously rejected batch, it will not fail dupe checking, because the initial submission was not accepted, it is not included in dupe checking comparisons. If you believe we rejected a batch in error, please contact your Relationship Manager, as the dupe check feature can be disabled for a particular batch, if necessary.

If Worldpay rejects a Batch for insufficient balance, do I need to resubmit it or will it process once the balance issues are resolved?

If we reject a Batch for insufficient funds, or any other reason, you must resubmit the Batch once the issue is resolved. We do not automatically re-run rejected submissions.

Is there a way to void a submitted funding instruction?

If you have coded to cnpAPI V10.1 or above, you can use a fundingInstructionVoid transaction to remove an instruction from the submitted batch, as long as you submit the void before the cutoff time on the same day you submitted the instruction you wish to void. For example, if your cutoff time is 7:00 PM and you submit a batch of funding instructions at 2:00 PM, you have until 7:00 PM to submit fundingInstructionVoid transaction(s) to remove one or more of the submitted funding instructions submitted in the original batch. If the void operation succeeds, Worldpay adjusts your available balance by the amount of the voided funding instruction within approximately 30 minutes. The voided fund are not available for distribution until that time.

Is there a way to search for funding instructions in iQ?

Yes. The Instruction Search page in iQ enables you to find information on funding instructions that Worldpay has processed, including credits and debits for PayFac, sub-merchant, reserve, and vendor (credit only) accounts. The Instructions Search Results provide a color-coded list based on your search criteria, of all exact, partial, and mis-matched data points. Instruction Search results also include Trace Number, the unique identifier of the funds transfer, as assigned by the bank. Please refer to the iQ eCommerce Reporting and Analytics User Guide for additional information.(see figure below).

When submitting a debit or credit to either a sub-merchant or vendor account I have to define the account type (<accType> element). How is this used?

This information is extremely important, since it determines the record type and format we submit for processing to the ACH network. Failure to properly define the account type could result in the rejection of the funding instruction by the ACH network. Use Checking or Savings to indicate the account is a consumer account and the type. Use Corporate or Corp Savings to indicate this is a corporate account and the type. Failure to properly define the account type could result in the rejection of the funding instruction by the ACH network.