General Questions

RealNet Payments LLC: 11000 W Lake Park Drive, Milwaukee, WI 53224 (800)729.8787.

Privacy statement found here.

What is Dynamic Payout?

Dynamic Payout is a method of distributing funds to your sub-merchants, other third party vendors (in the payment flow), and yourself, via the ACH network or the debit rails in the case of FastAccess funding. You must submit the funding instructions on the Worldpay eCommerce platform. RealNet Payments LLC performs the actual funds transfer.

What types of funding instruction do you support?

Dynamic Payout supports the following instructions:

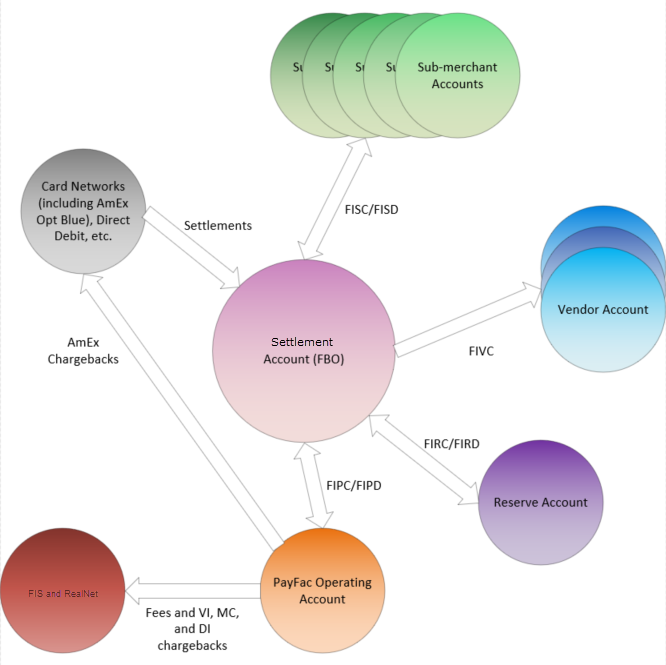

- Funding Instruction PayFac Credit (FIPC) - used to move funds from the PayFac FOB Settlement account to the PayFac Operating account.

- Funding Instruction PayFac Debit (FIPD) - used to move funds from the PayFac Operating account to the PayFac FBO Settlement account.

- Funding Instruction Reserve Credit (FIRC) - used to move funds from the PayFac FBO Settlement account to the PayFac Reserve account.

- Funding Instruction Reserve Debit (FIRD) - used to move funds from the PayFac Reserve account to the PayFac FBO Settlement account.

- Funding Instruction Sub-merchant Credit (FISC) - used to move funds from the PayFac FBO Settlement account to the sub-merchant Operating account.

- Funding Instruction Sub-merchant Debit (FISD) - used to move funds from the sub-merchant Operating account to the PayFac FBO Settlement account.

- Funding Instruction Vendor Credit (FIVC) - used to move funds from the PayFac FBO Settlement account to the Vendor account.

- Funding Instruction Void - used to void a submitted, but not yet settled, Funding Instruction.

- FastAccess Funding - used to transfer funds to certain eligible MasterCard or Visa debit cards. Transfer of funds takes place within 30 minutes.

Is Dynamic Payout the same as your Direct Debit offering?

No. Although both make use of the ACH network, Direct Debit is an alternative payment method used to accept payments for services or products, while Dynamic Payout is a method of distributing funds. Note: FastAccess Funding does not use the ACH network.

Can I use Dynamic Payout to distribute funds from transactions not processed through Worldpay?

No. Because the distributed funds must be tied to the originating transactions, you cannot distribute funds from transactions processed through a different platform.

What version of cnpAPI supports the use of Dynamic Payout?

cnpAPI version 9.0 and above supports the following transaction types: PayFac Credit/Debit, Reserve Credit/Debit, and sub-merchant Credit/Debit.

The following transaction type were added in cnpAPI version 9.2: Vendor Credit.

The Funding Instruction Void transaction type was added in version 10.1.

Worldpay added Same Day Funding capability in version 11.1.

What accounts are involved in Dynamic Payout?

The diagram below illustrates the various accounts, as well as the funding instructions associated with moving the funds between the accounts.

Can I use Dynamic Payout to distribute funds to only a portion of my portfolio of sub-merchants and pay other sub-merchants using a different method?

No. If you elect to use Dynamic Payout, you must use it for your entire portfolio of sub-merchants.

Can I use Dynamic Payout to distribute funds to multiple accounts for the same sub-merchant?

Yes, the instruction (cnpAPI message) for both the Funding Instruction Sub-merchant Credit (FISC) and Funding Instruction Sub-merchant Debit (FISD) contain an element used to define the sub-merchant account. To credit/debit multiple sub-merchant accounts, submit multiple funding instructions each specifying a different account.

Can I use Dynamic Payout to distribute funds generated by selected methods of payment, but not all?

No. Dynamic Payout must include funds generated by all methods of payment processed by the Payment Facilitator on the Worldpay platform, including AmEx OptBlue and Direct Debit.

Are there any requirements associated with the Dynamic Payout solution with respect to any of the card brands (i.e., Visa, MasterCard, Discover, and AmEx)?

There are no limitations for Visa and MasterCard. The following requirements apply to either Discover, American Express, or both:

- For Discover and American Express, transactions cannot be settled as conveyed transactions. Worldpay must be the acquirer.

- For American Express OptBlue, you must use the PayFac Merchant Provisioner API V11.1 or higher.

- You must fund all methods of payment processed by the Payment Facilitator on the Worldpay platform, including AmEx OptBlue and Direct Debit, using Dynamic Payout.

- You cannot use Dynamic Payout to distribute funds generated by transaction not processed by Worldpay.

Do you establish a unique Settlement and Reserve account for each Payment Facilitator?

No. Worldpay establishes and manages a single FBO (For Benefit Of) Settlement account and a single FBO Reserve account for all Payment Facilitators. Within these FBO accounts Worldpay maintains a separate logical account for each Payment Facilitator. Your logical account always reflects your active balance.

Can I use funding instructions to pay my bills or to allow sub-merchants to pay bills?

No. You can only use Dynamic Payout to fund entities in the payment stream. You can fund yourself, your sub-merchants, and third parties, such as market places that facilitate the payments, or check writing services that issue checks on your behalf to fund your sub-merchants.

Can other third parties send funds to the (FBO) Settlement account for me to fund my merchants?

No. Each dollar must be tied to a Merchant account on the Worldpay system. We cannot accept external funds that are not tied to an account (e.g., checks from a lock box).

Does Worldpay deduct fees prior to depositing funds in the FBO Settlement account?

No. Net settled sales (deposits - refunds) are deposited to the FBO Settlement account. Fees are debited directly from the PayFac Operating account. For example, on Day 1 you process a $100 Visa transaction. On Day 2, Worldpay deposits the $100 in the Settlement account and the appropriate fee is debited from your Operating account. You use funding instructions to move the funds from the Settlement account to your sub-merchant and recover your fees.

How do Direct Debit Deposit Returns, Credit Card Refunds, and Funding Instruction Rejects impact the balance in the FBO Settlement Account?

Direct Debit Deposit Returns have no impact on the FBO Settlement account. Credit Card Refunds do impact the balance, because funds deposited to the Settlement Account are Net Settled Sales (i.e., Deposits - Refunds). The Funding Instruction Reject would impact the balance only in that the funds you expected to move either into or out of the account would not move, because the instruction was rejected.

Credit Card Refund Example |

||

Day |

Action |

Result |

|

0 |

Credit Card Capture (Deposit) processed |

Net Funds (deposits - refunds) deposited to Settlement account. |

|

1 |

Funding Instructions submitted and accepted prior to cutoff to distribute funds from deposit to Sub-merchant and your Operating account (fees). |

None - funds moved next day. |

|

2 |

None |

Funds moved from Settlement account to Sub-merchant account and PayFac Operating account per Funding Instructions from Day 1. |

|

3 |

Credit Card Refund processed |

None - funds moved next day. |

|

4 |

None |

Net Funds (deposits - refunds) deposited to Settlement account. This accounts for the Refund from Day 3. |

|

5 |

Depending upon your business model and contract with the sub-merchant, you could submit Funding Instructions prior to cutoff to debit the Sub-merchant account for the refund. |

Amount of refund returned to the Settlement account. |

Funding Instruction Reject Example |

||

Day |

Action |

Result |

|

0 |

Credit Card Capture (Deposit) processed. |

None |

|

1 |

Funding Instructions submitted and accepted prior to cutoff to distribute funds from deposit to Sub-merchant and your Operating account (fees). |

Net Funds (deposits - refunds) deposited to Settlement account. |

|

2 |

None |

Funds debited from Settlement account per instructions. PayFac Operating account receives funds, but movement to Sub-merchant account fails. |

|

3 |

You receive notification (via iQ or SSR) of a rejected funding Instruction distributing funds to the Sub-merchant (FISC). |

Funds from failed transfer to Sub-merchant account returned to Settlement account. |

|

4 |

Determine root cause of failure and resubmit funding Instruction after issue resolved. |

|

|

5 |

None |

Funds debited from Settlement account per instructions. Sub-merchant account receives funds |

Direct Debit Return Example |

||

Day |

Action |

Result |

|

0 |

Direct Debit Sale (Deposit) processed |

None |

|

1 |

Funding Instructions submitted and accepted prior to cutoff to distribute funds from deposit to Sub-merchant and your Operating account (fees). |

Net Funds (deposits - refunds) deposited to Settlement account. |

|

2 |

None |

Funds moved from Settlement account to Sub-merchant account and PayFac Operating account per Funding Instructions from Day 1. |

|

3 |

None |

None |

|

4 |

You receive notification (via iQ or SSR) of an Direct Debit Return. |

None |

|

5 |

Depending upon the Return Reason code, you can initiate a redeposit. If the redeposit is not allowed, depending upon your business model and contract with the sub-merchant, you could submit Funding Instructions prior to cutoff to debit the Sub-merchant account for the return. |

Amount of return debited from your Operating account. Debits to Operating account include: Interchange Fees + Chargebacks + Assessments + Returns + Worldpay Fees. Note: No impact on Settlement account. |

|

6+ |

If the redeposit was allowed, but fails, depending upon your business model and contract with the sub-merchant, you could submit Funding Instructions prior to cutoff to debit the Sub-merchant account for the return. |

|