Refunding SEPA Direct Debit transactions

Only transactions in the SETTLED status can be refunded. This prevents the loss of funds, because a transaction in the SENT_FOR_AUTHORISATION state can be REFUSED by the shopper or their bank.

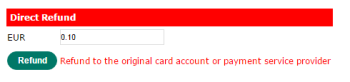

To refund (or partially refund) a SEPA Direct Debit transaction, use the Merchant Admin Interface (MAI).

Note: You can also supply XML refunds. For more information see the Modification requests section of the Worldwide Payment Gateway guide.

Refunds and chargebacks

Merchant initiated refunds for SEPA DD are bank transfers and are not offered as part of the SEPA DD scheme.

Worldpay use information from our partner bank to provide SEPA DD refunds, which are not governed by the SEPA DD scheme rules. We use the bank details provided at the back of a successful SEPA DD transaction. A refund internally within Worldpay is linked to a SEPA DD transaction.

But a shopper’s bank sees the refund as just another credit transaction. The shopper’s bank cannot know if the refund is just another credit or a refund against an existing SEPA DD transaction. This means that when a shopper goes to their bank and uses his/her right (under SEPA DD scheme rules) to chargeback a transaction, the bank do not know if the transaction has been refunded or not.

Also, remember that a shopper under SEPA DD scheme has an “eight weeks no questions asked” right to chargeback. The transaction is simply charged back by the shopper’s bank and you, the merchant, and Worldpay cannot defend it. Be very careful when you offer refunds. Only offer a refund when absolutely necessary, only offer refunds to the shoppers who have been thoroughly KYCd and for recurring transactions only. Inform the shopper of the refund time scales (three business days) to reduce a chance of a shopper initiated chargeback.