Click here to search worldpay.com

UnionPay

UnionPay is the national bankcard association in China and is thought to be the fastest growing card scheme in the world.

To use it, your shoppers need one of the following:

-

A UnionPay issued credit card

-

A UnionPay issued debit card

-

A bank account linked to the shopper's UnionPay issued debit card or credit card

UnionPay issue UnionPay cards globally, but only cards issued in certain countries are eCommerce enabled. Contact Worldpay for the latest list of countries that offer eCommerce-enabled cards.

For integration advice, please visit Worldpay developers.

The table shows the payment options in more detail:

| Options | Notes | Authorisation |

|---|---|---|

|

Credit card |

Shopper enters their card number followed by their card details and SMS verification code. |

Real-time |

| Debit card | Shopper enters their card number followed by their card details and SMS verification code. | Real-time |

|

Real time bank transfer |

This payment option allows the shopper to pay by a bank transfer. Shopper enters their card number, they are redirected to the card issuer's bank login page to complete the payment. |

Real-time |

Card and real time bank transfer options

You can switch off either the real time bank transfer or the card option. Before you do this, be sure you understand the implications (listed below). The reasons you might switch off bank transfer include:

-

You might present UnionPay bank transfer and the UnionPay card as two different payment methods that your shoppers can chose when they checkout. This enables you to monitor each payment option separately (for example, to measure conversion rates for bank transfer and conversion rates for card payments). At Worldpay we do this at boarding time. We board the UnionPay method to two different merchant codes, each with one of the options.

-

UnionPay card payments typically achieve higher acceptance rates for low-to-medium transaction values than UnionPay bank transfer payments. If acceptance rates are your key measure of success, switching off the bank transfer option might optimise acceptance rates. This may boost the acceptance rate, but it is also likely to decrease the overall volume of authorised payments as the shopper is presented with fewer options to complete their payment.

Please contact your Worldpay support representative if you need more details about these options. By default, we provide both payment options to you through a single connection unless you give us other instructions.

Shopper journey overview - desktops and other non-mobile devices

Note: For mobile and small screen devices, see the Shopper Journey overview - mobile and small screen devices section below.

To use this method to make a payment:

-

On the payment page, the shopper selects the UnionPay payment method.

The shopper is redirected to the UnionPay payment pages.

-

The shopper chooses the payment option that they wish to use and follows the on-screen instructions to complete the payment.

-

At the end of the shopper journey, the shopper may return on the successURL.

Note: The screenshots below are provided for guidance; they are correct as of February 2016. UnionPay may vary the wording and the appearance of the screens at any time.

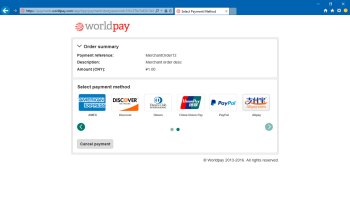

From the Worldpay payment page, the shopper selects UnionPay

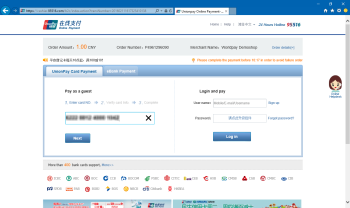

Shopper inputs the long card number and clicks Next

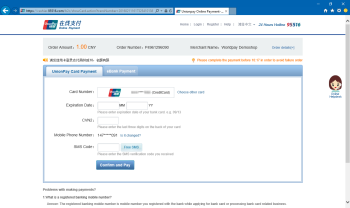

Shopper enters further details

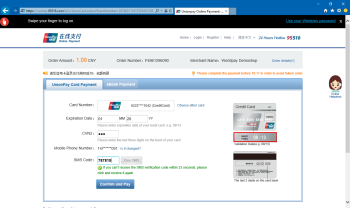

Shopper enters the SMS code that was received

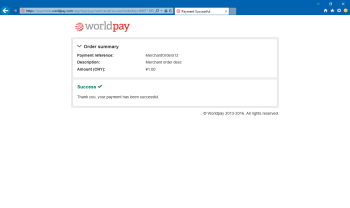

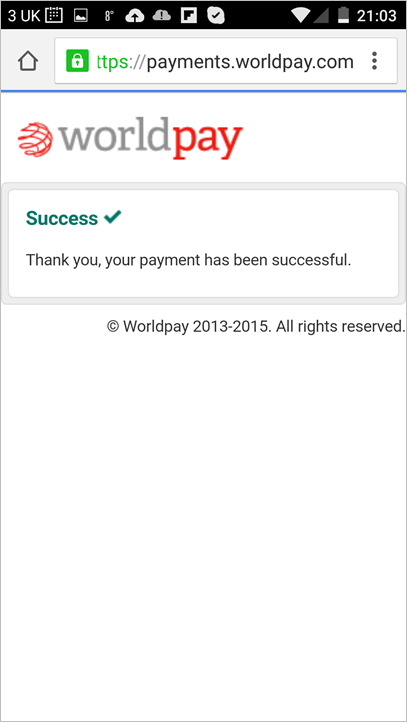

Shopper returns to Worldpay - successful payment

Shopper Journey overview - mobile and small screen devices

Note: The screenshots below are provided for guidance; they are correct as of February 2016. UnionPay may vary the wording and the appearance of the screens at any time.

To use this method to make a payment:

-

The shopper selects UnionPay and is taken to the UnionPay payment page.

-

The shopper follows the on-screen instructions to complete the payment.

-

The shopper receives the validation code by SMS text message.

-

The shopper inputs the validation code and presses the Confirm button.

-

The shopper returns to the success page.

-

An SMS text receipt is sent to the shopper

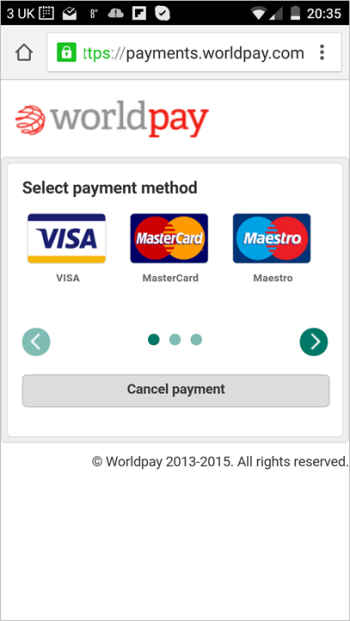

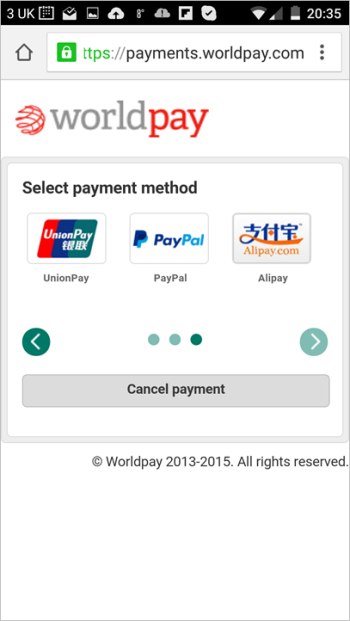

Select payment method

The shopper scrolls to UnionPay

Shopper lands on the UnionPay mobile page and inputs the card number

The page validates the card number and disguises it with *****

The shopper inputs the CVN2 and the card expiry date

Shopper clicks blue text (Confirm) to receive an SMS and authenticate the transaction.

Once the shopper clicks the blue text, they have 60 seconds to input the validation code that is in the SMS message. In the example above, the highlighted blue text shows 58; this means the shopper has 58 seconds left.

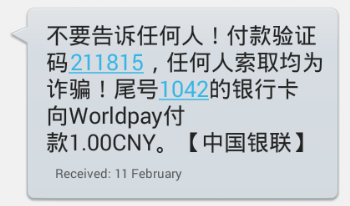

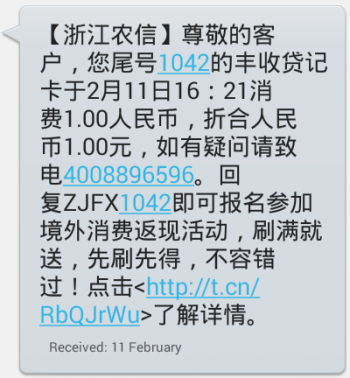

An example SMS message with the six digit validation code in blue

The SMS message above contains the shopper's one-time use PIN. In this example the PIN is 211815. The message also confirms the last four digits of the shopper's card (in this example 1024) and the amount being paid (CNY 1.00).

Shopper enters the validation code

The shopper returns to the success page

The shopper gets an SMS receipt

The SMS text message above confirms to the shopper that their card ending 1042 has been debited CNY 1.00 on February 11th at 16:21. It also provides a helpline number at UnionPay for shoppers to call in case of a query.

Integration considerations

It is important that you consider the following information when you integrate with UnionPay, in addition to the general integration recommendations provided in the XML Direct and Redirect Integration Mode section in the Overview part of this guide.

Payment completion

There are three possible outcomes for a UnionPay payment:

-

The shopper pays and the payment is authorised.

-

The shopper tries to pay, but the payment is declined. For example, because there are insufficient funds in the shopper's account.

-

The shopper selects something to buy, but does not try to make a payment. For example, the shopper is redirected to UnionPay but doesn't make the payment. This is known as an abandonment or non-completion.

There are two ways that you, the merchant, can find out the outcome of an individual payment:

-

The outcome is returned in the Worldpay payment notification (see the Payment timetable below).

-

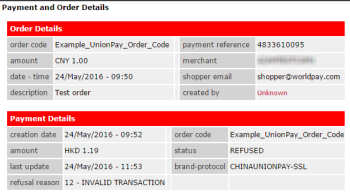

The outcome appears on the Worldpay Merchant Interface (see screenshot and example below).

Two fields that inform you of the outcome of the payment are:

-

Status

-

Refusal Reason

The table below shows the valid combinations of payment status and the reason the payment has been refused.

| Outcome | Status | Refusal Reason | Description |

|---|---|---|---|

|

The payment is authorised. |

AUTHORISED or CAPTURED |

The payment is successfully authorised. |

|

|

The shopper does not attempt to make a payment. |

REFUSED |

12 - INVALID TRANSACTION 21 - ILLEGAL TRANSACTION |

The shopper does not attempt a payment. After two hours, Worldpay polls UnionPay to request the outcome of the payment, and UnionPay confirm that they have no record of a valid payment attempt. |

|

The shopper attempts to pay but the payment is declined. Or the payment is not authorised for some reason. Warning: When a payment is REFUSED and the shopper clicks the 'Return Merchant' button, the shopper will not be returned to the merchant's website. Only a 404 error is displayed. A fix is in development but no time scale can currently be specified. |

REFUSED |

5 - REFUSED |

Authorisation has failed. The issuer has not provided a reason for failure. |

|

20 – ACQUIRER ERROR |

There was an unidentified error in UnionPay's processing. |

||

|

33 – CARD EXPIRED |

The shopper's card has expired, or the expiry date input by the shopper was not correct. |

||

|

34 – FRAUD SUSPICION |

UnionPay or the issuer declined the payment due to suspected fraud. |

||

|

51 – LIMIT EXCEEDED |

The shopper has exceeded their card limit, used up all their balance or exceeded the payment limit imposed by their bank. |

||

|

55 – INVALID SECURITY CODE |

The security code (CVN) was not correct, or the one time pin (OTP) was not correct. |

||

|

68 - TRANSACTION TIMED OUT |

The transaction timed out during processing. |

||

|

85 – REJECTED BY CARD ISSUER |

The issuer has rejected the transaction but we don't know why. |

||

|

94 – DUPLICATE REQUEST |

UnionPay or the issuer believes this transaction to be the duplicate of another transaction. |

||

|

104 – UNKNOWN CARD |

The shopper input an invalid card number, or the card was not recognised by the issuer. |

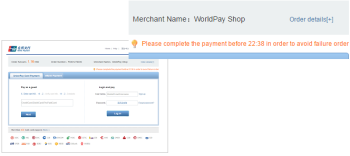

Control the shopper payment window

You can control how long the shopper has to complete their payment.

This is useful in some circumstances, for example if you have inventory that you can only hold for a short time. The default setting gives shoppers two hours to complete their payment. The two hours starts at the moment the shopper lands on the UnionPay payment pages, and UnionPay show the shopper the deadline to make the payment.

The shopper cannot complete their payment beyond this period.

If you want, we can reduce this two hour period to a shorter period (the minimum is 20 minutes). Please contact Worldpay Support or your Relationship Manager (RM) if you'd like to do this. This timeout works as follows:

-

If the shopper submits their valid payment details on the UnionPay payment page before the timeout, UnionPay submits the payment to the issuer for authorisation. Note that, as authorisation can be asynchronous in some cases, the authorisation response can be received after the timeout has elapsed. For example, if you set the timeout to 30 minutes and the shopper submits their payment information on 28 minutes, the authorisation response could be received on 31 minutes or later. The timeout only controls when the shopper can submit their payment; it does not guarantee that a response is received before the timeout elapses.

-

If the shopper submits their valid payment details on the UnionPay payment page after the timeout, UnionPay shows the shopper an exception message and prevents them from completing the payment. Worldpay will then notify you that the payment has not been completed.

-

There is a potential situation where the shopper submits their valid payment details at the exact moment that the timeout is about to elapse. In such cases, UnionPay may attempt to authorise the payment with the issuer. The issuer may subsequently authorise the payment, but UnionPay will cancel the payment in order to provide the merchant with a more consistent experience. Such cancellations are typically real time (meaning all evidence of the transaction is immediately erased from the shopper’s statement leaving no trace of the original transaction); but in some cases it can take up to a few days for the cancellation to complete. If UnionPay cancels a payment in this way then Worldpay will notify you that the payment has not been completed.

Please think about the following when you decide what is the best setting for the timeout:

-

Normally, a longer timeout period gives you higher acceptance rates (the longer you give the shopper to make the payment the greater the possibility of the shopper completing the payment). Bear in mind that there are several steps that the shopper needs to complete (including receiving a one-time PIN via SMS in some cases) so it is important to give the shopper enough time.

-

A shorter timeout period might be better if you have time-critical inventory to manage (e.g. a hotel room booking that you can only hold for a few minutes) but the trade-off may be a lower overall rate of acceptance, as some shoppers cannot complete the payment before the timeout.

-

The timeout only controls when the shopper can submit the payment; it does not guarantee that the authorisation response will be received before the timeout elapses.

Recipient

You should consider making your shoppers aware that:

-

Your shop name appears as the payment recipient on the UnionPay payment pages.

-

Your shop name appears as the payment recipient on the shopper’s card statement.

-

Your shop name appears as the sender of the payment on the shopper’s card statement in the case of a direct refund.

Please see the Dynamic Descriptor and Shop Name screen shot and the Shoppers Card Statement screen shot in the Example XML topic below, for an example of how the shop name appears to the shopper.

Checking the name associated with the shop name under Profile within the Merchant Interface for the Merchant Code is adequate, and pre-advising the shopper accordingly may reduce shopper abandonment.

To check or change the shop name associated with a merchant code, please contact your Worldpay support representative.

Browser compatibility

The UnionPay payment pages are compatible with a wide range of web browsers, and a UnionPay plug-in may be required (see Browser plug-in table below).

Browser plug-in

In certain cases, shoppers must download and install a browser plug-in. The table shows when this is needed:

| Payment option | Needs a plug-in? |

|---|---|

| Credit card (desktop) | No |

| Debit card (desktop) | Yes (UnionPay plug-in) |

| Online banking (desktop) | Depending on the bank, a bank plug-in may be needed. |

| Credit card, debit card (mobile) | No |

Payment method properties

The properties for the payment method appear in the table below:

| Property | Description/ Value |

|---|---|

|

Payment Type |

Debit / Credit Card payment and internet banking. |

|

Countries |

Shoppers can use UnionPay in any country. However, only cards in China are fully eCommerce enabled. In Hong Kong and Macau only credit cards can be eCommerce enabled, as local laws do not allow the use of a debit card online. This means that if, for example, you offer UnionPay to shoppers in Europe, you may get lower conversion rates. This is because there is a higher chance that these shoppers have cards that they cannot use for eCommerce transactions. Contact Worldpay for a current list of enabled countries and future countries. |

|

Acceptance Currencies |

We recommend that you price and authorise in the currency that your shopper will ultimately be debited in. For example if the shopper is using a Chinese issued UnionPay card, we recommend that you price in CNY and authorise in CNY. Similarly, if the shopper has a Japanese issued UnionPay card, we recommend that you price and authorise in JPY. This gives the best shopper experience as the shopper is ultimately debited in the same currency. It is also possible to authorise payments in the currencies below. If you choose to use one of these currencies, shoppers see a foreign exchange conversion to CNY on the UnionPay pages. To avoid this conversion we recommend that you show your prices in the same currency that the shopper will be debited in – this helps to maximise conversion rates. AED, AUD, AZN, BDT, BGN, BHD, BND, BRL, CAD, CHF, CNY, CZK, DZD, EGP, EUR, GBP, GEL, HKD, HRK, IDR, INR, JOD, JPY, KRW, KWD, KZT, LAK, LKR, MOP, MRO, MYR, NOK, NPR, NZD, OMR, PGK, PHP, PKR, QAR, RUB, SEK, SGD, THB, TND, TRY, TWD, UAH, USD, VND, ZAR |

|

Settlement Currencies |

Worldpay can support like-for-like (authorization -> merchant transfer) in the following currencies: GBP, EUR, HKD, SGD and USD. For any other currency combinations (e.g. authorization in CNY) there is an FX charge between the authorization currency and merchant transfer currency. We can authorize payments in any of the above acceptance currencies, and transfer to the merchant in any of the published Worldpay transfer currencies. |

|

Preferred Currency |

CNY |

|

Shopper Debit Currency |

CNY |

|

Minimum Amount for a Single Transaction |

No minimum. |

|

Maximum Amount for a Single Transaction (Individual card issuers and banks may impose their own limits) |

Card issuer dependent - the amount is the shopper's card limit. USD 5000 for restricted MCC (Merchant Category) codes. See the Restricted Merchant Category Codes (MCC) - USD 5000 transaction limit table below. |

|

Direct Refunds (Yes/No) |

Yes. See the Refunds Capability table for limitations. |

|

Direct Refund Period |

365 days UnionPay can accept a refund request up to 365 days after the original authorisation, and most issuers will also accept such a request. However, a small number of issuers might support a shorter refund period (UnionPay regulation makes the issuers accept refunds up to 30 days after the original authorisation completion). |

|

Bank Transfer Refunds |

No |

|

Chargebacks (Yes/No) |

Yes |

|

Payment Method Mask |

CHINAUNIONPAY-SSL |

|

Supported Languages |

ZH, EN, KO, JA The supported language is auto-detected by UnionPay dependant on the language setting of the shoppers web browser, it is not based on the language parameter submitted to Worldpay. Simplified Chinese appears on the UnionPay payment pages for any language that is not supported that the system detects on the shoppers web browser. Shoppers can switch between supported languages on the UnionPay payment pages. Worldpay do not support non-Latin characters in the statement narrative or dynamic descriptor. |

|

statementNarrative (Yes/No) |

Yes |

|

Dynamic Descriptor (Yes/No) |

Yes |

|

Payment Traceability |

Payment Reference - this is searchable in the MI and in Worldpay’s back office system as the ‘Internal Order ID’. It appears on the UnionPay payment pages. It’s also returned as the ‘Reference ID’ in the XML response from Worldpay. |

|

Direct Model (Yes/No) |

No |

|

Redirect Model (Yes/No) |

Yes |

|

Sandbox (Yes/No) |

Yes |

|

Service Level |

M-Level |

|

Restrictions |

See tables below |

Prohibited merchant category codes (MCC)

If you, the merchant have this MCC category, you cannot use UnionPay.

| MCC |

Description |

|---|---|

|

0763 |

Agricultural co-operatives |

|

4829 |

Wire transfers and money orders |

|

6012 |

Financial institutions - merchandise and services |

|

6051 |

Non-financial institutions - foreign currency, money orders |

|

6211 |

Securities - brokers and dealers |

|

7995 |

Betting, including lottery tickets, casino gaming chips, off-track betting and wagers at race tracks |

Restricted merchant category codes (MCC) - USD 5000 transaction limit

If you, the merchant have this MCC category, you can use UnionPay, subject to a limit of $5,000 per transaction.

| MCC | Description |

|---|---|

|

0743 |

Wine producers. |

|

0744 |

Champagne producers. |

|

1520 |

General contractors - residential and commercial. |

|

1740 |

Masonry, stonework, tile setting, plastering and insulation. |

|

1750 |

Carpentry contractors. |

|

1761 |

Roofing, siding and sheet metal work contractors. |

|

1771 |

Concrete work contractors. |

|

1799 |

Special trade contractors - not elsewhere classified. |

|

2744 |

Miscellaneous publishing and printing services. |

|

2791 |

Typesetting, plate making and related services. |

|

2842 |

Speciality cleaning, polishing and sanitation preparations. |

|

4011 |

Railways. |

|

4214 |

Motor freight carriers and trucking - local and long distance, moving and storage companies, and local delivery. |

|

4225 |

Public warehousing and storage - farm products, refrigerated goods and household goods. |

|

4468 |

Marinas, marine services and supplies. |

|

4582 |

Airports, flying fields and airport terminals. |

|

5013 |

Motor vehicle supplies and new parts. |

|

5021 |

Office and commercial furniture. |

|

5039 |

Construction materials - not elsewhere classified. |

|

5044 |

Office, photographic, photocopy and microfilm equipment. |

|

5045 |

Computers, computer peripheral equipment - not elsewhere classified. |

|

5046 |

Commercial equipment - not elsewhere classified. |

|

5047 |

Dental, laboratory, medical, ophthalmic hospital equipment. |

|

5051 |

Metal service centres and offices. |

|

5065 |

Electrical parts and equipment. |

|

5072 |

Hardware equipment and supplies. |

|

5074 |

Plumbing and heating equipment and supplies. |

|

5085 |

Industrial supplies - not elsewhere classified. |

|

5094 |

Precious stones and metals, watches and jewellery. |

|

5099 |

Durable goods - not elsewhere classified. |

|

5111 |

Stationary, office supplies and printing and writing paper. |

|

5122 |

Drugs and drug proprietors. |

|

5131 |

Piece goods, notions and other dry goods. |

|

5137 |

Men’s, women's and children's uniforms and commercial clothing |

|

5139 |

Commercial footwear. |

|

5169 |

Chemicals and allied products - not elsewhere classified. |

|

5172 |

Petroleum and petroleum products. |

|

5192 |

Books, periodicals and newspapers. |

|

5198 |

Paints, varnishes and supplies. |

|

5199 |

Non-durable goods - not elsewhere classified. |

|

5211 |

Lumber and building material outlets. |

|

5551 |

Boat dealers. |

|

5599 |

Miscellaneous automotive, aircraft and farm equipment. |

|

5715 |

Alcoholic beverage wholesaler. |

|

5960 |

Direct marketing - insurance services. |

| 5969 | Direct marketing, not elsewhere classified. This includes multilevel marketing, also known as pyramid selling, network marketing and referral marketing. |

|

6300 |

Insurance sales, underwriting or premiums. |

|

7311 |

Advertising services. |

|

7321 |

Consumer credit report agencies. |

|

7322 |

Debt collection agencies. |

|

7333 |

Commercial photography, art or graphics. |

|

7361 |

Employment agencies and temporary help services. |

|

7372 |

Computer programming, data processing or integration. |

|

7375 |

Information retrieval services. |

|

7379 |

Computer eminence and repair services - not elsewhere classified. |

|

7392 |

Management consulting and public relations services. |

|

7399 |

Business services - not elsewhere classified. |

|

7829 |

Motion picture and video tape production and distribution. |

|

7993 |

Video amusement games. |

|

7997 |

Membership clubs (sports, recreation or athletic), country clubs and private golf courses. |

|

8110 |

Legal services and attorneys. |

|

8398 |

Charitable and social service organisations. |

|

8641 |

Civic, social and fraternal associations. |

|

8651 |

Political organisations. |

|

8661 |

Religious organisations. |

|

8911 |

Architectural, engineering and surveying services. |

|

8931 |

Accounting, auditing and bookkeeping services. |

|

8999 |

Professional services - not elsewhere classified. |

Payment timetable

The payment status is expected to change according to the following timetable:

| Trigger | Delay | Payment status | Notes |

|---|---|---|---|

|

Shopper chooses UnionPay method |

0 |

Payment is created in SHOPPER _REDIRECTED status. |

|

|

Shopper makes immediate payment on the UnionPay website |

Typically minutes |

|

Payment made either by SecurePay or eBank-Pay. |

|

PSP authorises the payment |

0 minutes |

AUTHORISED |

The payment is authorised in real time. |

|

Worldpay capture the payment |

< 1 hour |

CAPTURED |

|

|

Worldpay clears and settles the payment internally |

2 to 4 days |

SETTLED |

|

|

Worldpay settles to the merchant |

n working days |

|

The settlement to the merchant occurs according to the normal merchant settlement cycle. |