Click here to search worldpay.com

About Sofort and Pay now.

If you currently use SOFORT, please take the following required actions:

-- Remove all SOFORT integrations, logos, or references from your platform and checkout front end to prevent shoppers from encountering errors.

-- Adopt a replacement payment method such as Klarna to ensure uninterrupted service. Contact your Relationship Manager for more information.

SOFORT Banking is a real-time bank transfer payment method that shoppers based in Austria, Belgium, Germany and Switzerland can use to transfer funds directly to merchants from their bank accounts.

For integration advice, please visit Worldpay developers.

Note: On the 28th of August 2017, SOFORT Banking changed its name to Pay now. by Klarna. This change affects Belgium. In Austria, Germany and Switzerland the name changes to Sofort. The logos have changed for all countries - see the Pay now and Sofort logos section below.

The following payment options are available to the shopper once they re-direct to the Sofort or Pay now. payment page:

| Options | Notes | Authorisation |

|---|---|---|

|

Real-time bank transfer |

Shopper enters their sort code/bank code. They enter a username and password to login to their bank account. They then enter a transaction authentication number (TAN) or equivalent depending on the country and their bank. There is also an option to download a java app to connect the shopper to their bank. Shopper chooses the ‘HBCI-Karte oder Stick/Diskette’ option. Payment is authorised in real-time, the shopper should return on the merchants supplied ‘successURL’. |

Real-time |

Shopper journey overview

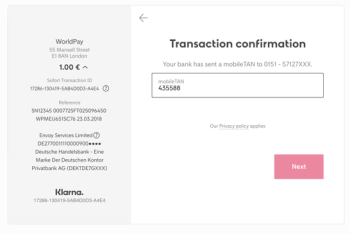

Online payment from a PC, laptop or similar device

Note: The screenshots below are for guidance only and are correct as of March 2018. Sofort can make changes to the words, graphics and layout at any time.

To use this method to make a payment:

-

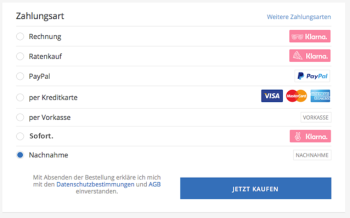

On the payment page, the shopper selects the Sofort or Pay now. payment method.

-

The shopper is redirected to the Sofort. or Pay now. website.

-

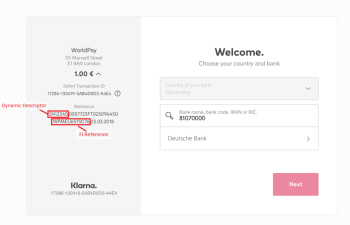

On the website, the shopper selects their bank and clicks Next.

-

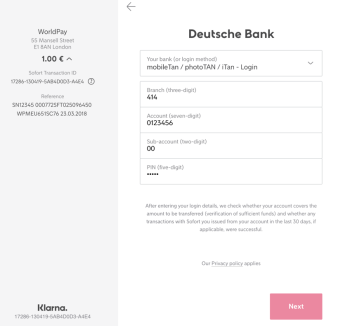

The shopper enters their online bank account details and clicks Next.

-

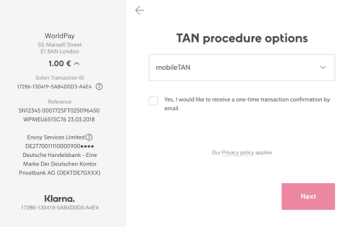

The bank sends a TAN (Transaction Authentication Number) to the shopper's mobile device. The shopper enters the TAN into the field and clicks Next to confirm the transaction.

-

The shopper is redirected to your (the merchant's) website.

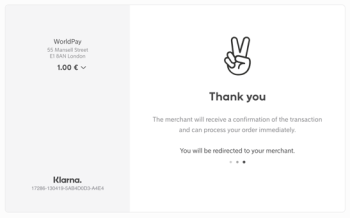

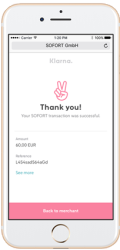

Payment from a mobile device

To use a mobile device to make a payment:

-

The shopper selects Sofort. or Pay now. as a payment method on their mobile device.

-

The shopper is redirected to the Sofort. or Pay now. website.

-

On the website, the shopper selects their bank and taps Continue.

-

The shopper enters their online bank account details and taps Continue.

-

The bank sends a TAN (Transaction Authentication Number) to the shopper's mobile device. The shopper enters the TAN into the field and taps Confirm to confirm the transaction.

-

The shopper receives a confirmation message that the transaction was successful. The shopper taps Back to merchant and is redirected to the your (the merchant) website.

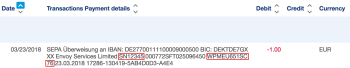

Shopper's bank statement

This is an example of how a Sofort transaction appears on your shopper's bank statement.

The dynamic descriptor is SN12345.

The FI reference is WPMEU651SC76 .

Integration considerations

It is important that merchants consider the following information when they integrate with Sofort or Pay now. This is in addition to the general integration recommendations in Overview of Alternative Payment Methods section and the APM Categories and Payment Flows section.

Time out

There is no time-out value for the shopper to enter their bank code/sort code on the Sofort or Pay now. payment page. After a shopper enters the bank code/sort code they select ‘Weiter’’ to go to the next page to enter bank account login credentials.

The shopper has six minutes to enter their bank account login username and password, on the Sofort or Pay now. payment page, and then select ‘Weiter’’ to go to the next page to enter a TAN (Transaction Authentication Number).

The shopper has between 5 to 10 minutes to enter their TAN number on the Sofort or Pay now. payment page. After the shopper enters the TAN number they select ‘Weiter’’ to complete the payment. This 5 to 10 minute time-out is different for each bank.

We recommend that merchants advise the shopper of any time-out value. This ensures that shoppers are aware of how long they have to complete the payment, once they are on the Sofort or Pay now. payment page.

Recipient

Merchants should make shoppers aware that:

- Worldpay or Envoy Services Limited will appear as the payment recipient on the Sofort or Pay now. payment pages.

- Depending on the shopper’s bank, ‘ENVOY SERVICES LIMITED’ or ‘Worldpay AP Ltd’ will appear as the payment recipient on the shopper’s bank account statement.

- Depending on the shopper’s bank the shopper will see ‘Worldpay AP Ltd’ or ‘ENVOY SERVICES LIMITED’ as the payer for refunds in their bank account statement. They will also see the ‘FI Reference Code’ for the original payment next to the refund entry. They will also see the merchant’s statement narrative next to the refund entry if one is supplied.

Pre-advising the shopper of the recipient’s name may reduce shopper abandonment, shopper queries or disputes.

Pay now and Sofort logos

Klarna advise merchants to use an appropriate Sofort or Pay now. logo depending on the shopper’s country.

For shoppers in Austria, Germany and Switzerland show this logo on your payment page:

For shoppers in France and Belgium show this logo on your payment page:

For shoppers in the Flemish part of Belgium, show this logo on your payment page:

For shoppers in Italy, show this logo on your payment page:

For shoppers in Spain, show this logo on your payment page:

The home page logo is now Klarna for all countries:

This is the black Klarna logo:

This is also a white Klarna logo for web pages with a dark background colour.

Sofort and Pay now. may update their logo and banner at any time. The logos and banners in this version of the APM Guide are correct as of August 2017. To check and obtain the current logos and banners, see the Klarna developers website:

https://developer.klarna.com/en

Payment method properties

| Property | Description/Value |

|---|---|

|

Payment Type |

Real-time bank transfer |

|

Countries |

Austria, Belgium, Germany and Switzerland |

|

Acceptance Currencies |

EUR, CHF (CHF for Switzerland only) |

|

Settlement to Worldpay Currency |

EUR, CHF (CHF for Switzerland only) |

|

Minimum Amount for a Single Transaction |

1 EUR 5 CHF |

|

Maximum Amount for a Single Transaction |

2000 EUR 2500 CHF Note: Individual banks may impose their own transaction limits. |

|

Direct Refunds (Yes/No) |

Yes See the WPG Refunds Capability table ( |

|

Direct Refund Period |

See the WPG Refunds Capability table ( |

|

Bank Transfer Refunds (Yes/No) |

Yes. See the WPG Refunds Capability table ( |

|

Bank Transfer Refund Period |

See the Refunding Alternative Payments Guide for any limitations. |

|

Chargebacks (Yes/No) |

Yes |

|

Payment Method Mask |

SOFORT-SSL SOFORT_CH-SSL (available in Switzerland only) |

|

Supported Languages per country |

Austria (DE, EN) Belgium (NL, FR, EN, DE) Germany (DE, EN) Switzerland (DE, FR, EN, IT) |

|

Statement Narrative (Yes/No) |

Yes |

|

Dynamic Descriptor (Yes/No) |

Yes |

|

Payment Traceability |

FI Reference Code - this is searchable in WorldPay’s Back Office system and in the Merchant Interface. It appears on the Sofort or Pay now. payment pages and the shopper’s Sofort or Pay now. statement. |

|

Direct Model (Yes/No) |

Yes |

|

Redirect Model (Yes/No) |

Yes |

|

Sandbox (Yes/No) |

Yes |

|

Service Level |

M-Level |

Payment timetable

The payment status is expected to change according to the following timetable.

| Trigger | Delay | Payment status | Notes |

|---|---|---|---|

|

The shopper chooses the Sofort or Pay now. method |

0 minutes |

Payment is created in SHOPPER _REDIRECTED status. |

|

|

Shopper makes an immediate payment on the Sofort or Pay now. website |

Typically minutes |

|

Payment made by real-time bank transfer. |

|

PSP authorises the payment |

0 minutes |

AUTHORISED |

The payment is authorised in real time. However, there can be a delay of up to five seconds. |

|

Worldpay capture the payment |

< 1 hour |

CAPTURED |

|

|

Worldpay clears and settles the payment internally |

5 working days |

SETTLED |

|

|

Worldpay settles to the merchant |

n working days |

|

The settlement to the merchant occurs according to the normal merchant settlement cycle. |