Click here to search worldpay.com

About paysafecard

The paysafecard is primarily a prepaid card that shoppers can use to make online payments. Shoppers do not have to enter personal information or bank details when they pay. They can use the paysafe card in the countries listed in the Payment Method Properties table below. A shopper can combine up to 10 paysafecard PINs (Personal Identity Numbers) to make a single larger payment.

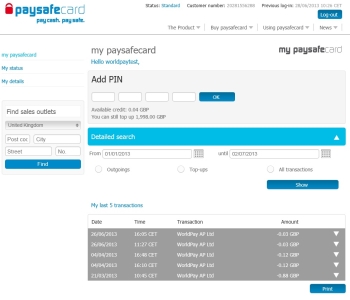

It is also possible to store and manage a number of paysafecard PINs in an online eWallet called ‘My paysafecard’. Once the shopper adds the PIN to his or her eWallet, the PIN is no longer required to make a payment. Instead shoppers only have to enter their ‘My paysafecard’ username and password. Shoppers can also use ‘My paysafecard’ eWallet to view their transaction history.

For integration advice, please visit Worldpay developers.

Shopper journey overview

To use a paysafecard to make a payment:

-

On the payment page, the shopper selects the paysafecard payment method.

The shopper is redirected to the paysafecard website.

-

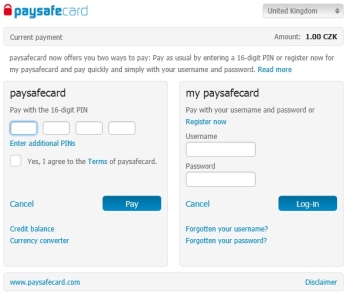

The shopper either enters their 16-digit paysafecard PIN or their ‘my paysafecard’ username and password to login to their eWallet.

-

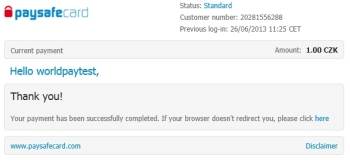

The shopper follows the onscreen instructions and completes the payment.

-

At the end of the shopper journey, the shopper may return on the successURL.

Note: The screenshots below are provided for guidance purposes only and are correct as of July 2013. The paysafecard company may vary the wording and layout of the payment screens at any time.

paysafecard - Landing Page

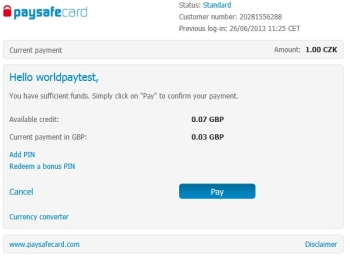

My paysafecard - eWallet Payment

My paysafecard eWallet Payment Confirmation

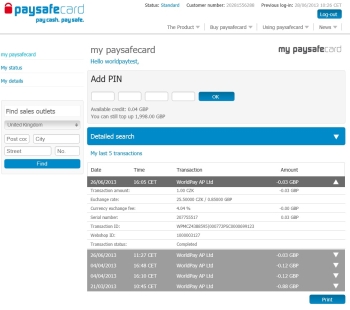

my paysafecard eWallet Statement

my paysafecard eWallet Individual Payment Details

Integration considerations

Payment time out

There is a 30-minute timeout for the shopper to complete their payment. This 30-minute timeout starts from the moment the shopper arrives at the paysafecard payment page. This timeout is not configurable. To complete a payment, shoppers enter a paysafecard PIN (Personal Identity Number), or their my paysafecard username and password, and click on Pay.

Recipient

We recommend that merchants make their shoppers aware that Worldpay AP Ltd appears as the payment recipient on the shopper's paysafecard statement. Shoppers who are aware of this are less likely to abandon the transaction.

Payment method properties

| Property | Description/Value |

|---|---|

|

Payment Type |

Prepaid card / eWallet |

|

Countries |

Austria, Belgium, Cyprus, Czech Republic, Denmark, France, Germany, Greece, Ireland, Italy, Liechtenstein, Luxembourg, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, and the United Kingdom |

|

Acceptance Currencies |

CHF, CZK, DKK, EUR, RON, GBP, NOK, PLN, SEK, and USD |

|

Preferred Currency |

CHF |

|

Settlement to Worldpay Currency |

Payments made in RON and NOK are settled in EUR. Payments made with any other acceptance currency are settled in the same currency. |

|

Shopper Debit Currency |

The same currency as the funds on the card / eWallet regardless of authorisation currency. |

|

Minimum Amount for a Single Transaction |

1 GBP. |

|

Maximum Amount for a Single Transaction |

1,000 EUR |

|

Direct Refunds (Yes/No) |

No |

|

Bank Transfer Refunds (Yes/No) |

Yes. See the WPG Refunds Capability table for limitations. It's available at

|

|

Bank Transfer Refunds Period |

See the WPG Refunds Capability table for details. It's available at

|

|

Chargebacks (Yes/No) |

No. All payments are guaranteed and there is no risk of chargeback to merchants. |

|

Payment Method Mask |

PAYSAFECARD-SSL |

|

Supported Languages |

DA, DE, EL, EN, ES, FR, IT, NL, NO, PL, PT, RO, SI, SK, SV |

|

statementNarrative (Yes/No) |

No |

|

Dynamic Descriptor (Yes/No) |

No |

|

Payment Traceability |

The FI reference appears to the shopper (e.g WPMCZ1234567) listed as Transaction ID. This appears in the Backoffice and MAI. |

|

Direct Model (Yes/No) |

Yes |

|

Redirect Model (Yes/No) |

Yes |

|

Sandbox test system (Yes/No) |

Yes |

|

Service Level |

M-Level |

|

Restrictions |

None |

Currency constraints

The paysafecard authorises a payment made in a particular currency only if the shopper has bought the card in a country that supports that currency. For example, CZK transactions are authorised only if the shopper has purchased the card in one of the countries included in the Standard Card Group**.

Note: The term country refers to the country in which the card has been issued. This may be a different country from the shopper’s home country or country of residence.

The valid country/currency combinations appear in the following table.

| Payment currency | Card issues in ...* |

|---|---|

|

CHF, EUR, GBP |

Standard card group**, Canada, Croatia, Mexico |

|

USD (Gaming Merchants) |

Standard card group**, Canada, Croatia, Mexico |

|

USD (All other Merchants) |

Standard card group**, Canada, Croatia, Mexico and the USA |

|

CZK, DKK, NOK, PLN,SEK,RON |

Standard card group** |

* Refers to the country in which the paysafecard has been issued and is not the same as the shopper's declared country.

** The standard country group is comprised of the Eurozone countries plus Denmark, Romania, Lithuania, Poland, Switzerland, Czech Republic, Norway, Latvia, Gibraltar, Hungary, Sweden and the UK.

Country lock-in

Country Lock-in is an optional feature of the paysafecard service. Use it to impose additional constraints on the transaction based on the shopper’s declared country, and the paysafecard they use to pay.

When the country lock-in is switched on, shoppers in countries that support country lock-in can only use a paysafecard which was bought in their country.

The default setting is country lock-in OFF. If you want to enable the country lock-in function, contact your Worldpay support contact.

| Shopper declared currency | Lock-in supported |

|---|---|

|

Austria, Belgium, Czech Republic, Denmark, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovenia, Spain, Sweden, Switzerland, United Kingdom |

Yes |

|

Cyprus, Liechtenstein, Romania and Slovakia |

No |

Country lock-in applies only to shoppers in the indicated countries. For example, a shopper tries to pay with a card that was not purchased in their declared country, and country lock-in applies. An exception message appears on the paysafecard website. The shopper cannot complete their payment with the specified card.

Some more examples with country lock-in switched on:

- Shoppers in the UK can only use cards purchased in the UK

- Shoppers in Slovakia can use cards purchased in all territories

Conversely, with country lock-in switched off:

- Shoppers in the UK can use cards purchased in all territories

- Shoppers in Slovakia can use cards purchased in all territories

If you the merchant, decide to use country lock-in, you must control the shopper’s declared country and pass the correct country code to the WPG service.

If you use the REDIRECT model, you must not allow the shopper to change their declared country on the Worldpay payment pages. To stop shoppers changing their country:

-

Go to the Merchant Interface (MAI) and open the merchant profile shopper pages.

-

Set the Country/Language selection option to NO.

Note: This setting applies to all payment methods under this merchant code. You will also need to specify the country code in your call to the REDIRECT API.

From the paysafecard website, the shopper can still try to use the drop-down country selector to change their country, but this function is disabled.

Note: Think carefully before you enable country lock-in. It is likely that you will see an increase in the number of incomplete transactions and a decrease in conversion rate. This is because certain types of shopper cannot complete their payments.

Currency convertor

paysafecard allows shoppers to hold money in a currency on their paysafecard or in their My Paysafecard eWallet account, but pay in a different currency. paysafecard converts the currencies and charges the following fees:

|

paysafecard currency |

Webshop's currency |

Foreign currency fee |

|---|---|---|

|

EUR |

USD, GBP, CHF,CZK, PLN, DKK, RON, SEK, NOK |

2.0% |

|

USD, GBP, CHF, CZK, PLN, DKK, RON, SEK, NOK |

EUR |

2.0% |

|

USD, GBP, CHF, CZK, PLN, DKK, RON, SEK, NOK |

USD, GBP, CHF, CZK, PLN, DKK, RON, SEK, NOK |

4.04% |

Payment timetable

The payment status is expected to change according to the following timetable:

| Trigger | Delay | Payment status | Notes |

|---|---|---|---|

|

Shopper chooses paysafecard method |

0 |

Payment is created in SHOPPER _REDIRECTED status |

|

|

Shopper makes immediate payment on the paysafecard website |

Typically minutes |

|

|

|

Payment Service Provider (PSP) authorises the payment |

0 |

AUTHORISED |

The payment is normally authorised in real time. |

|

Worldpay capture the payment |

<1 hour |

CAPTURED |

|

|

Worldpay clears and settles the payment internally |

12 - 13 working days |

SETTLED |

|

|

Worldpay settles to the merchant |

n working days |

|

The settlement to the merchant occurs according to the normal merchant settlement cycle. |