Click here to search worldpay.com

About Giropay

Giropay is a very popular online banking payment system in Germany.

It allows shoppers to pay for your goods or services with an online bank transfer.

Giropay is a secure and reliable payment method, which uses shopper's own online banking details (PIN) and a TAN (Transaction Authentication Number) to authorise the payment. Small payments (30 Euro and below) often don't need a TAN.

For integration advice, please visit Worldpay developers.

For restrictions on the type of business activity imposed by Giropay, see the Restrictions section at the end of this topic.

Shopper journey

The shopper selects the Giropay payment method, confirms their bank and the system redirects to their bank to complete their payment. The bank provides a real-time notification for authorised payments.

Note: For screenshots of these shopper journeys, see Shopper experience - Screens.

The shopper journey is the same, for both desktop devices and mobile devices.

Your shopper:

-

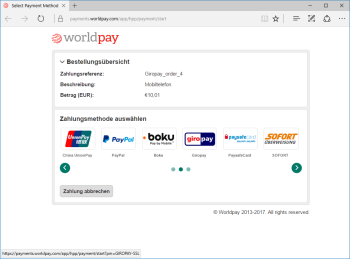

Selects the Giropay payment method from the payment methods screen. The shopper is redirected to the Giropay payment pages.

-

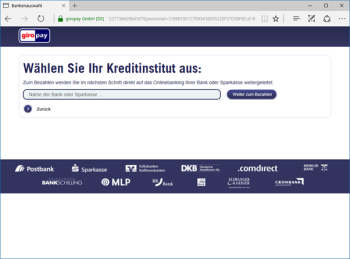

The shopper inputs the name of their bank. This screen does not appear if you, the merchant, include the BIC (Business Identifier Code) of the shopper’s bank in the XML request.

-

The shopper is redirected to their bank, where they input their login credentials.

-

The shopper completes the payment using their bank’s standard authentication method, for example TAN (Transaction Authentication Number).

-

After successfully completing their payment, the shopper is redirected back to your successURL.

Shopper experience - Screens

This sections contains a selection of screens that appear to your shopper.

Note: The screenshots are for guidance; they are correct as of February 2017. Giropay may vary the wording and the appearance of the screens at any time.

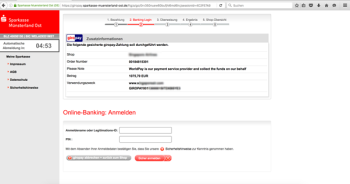

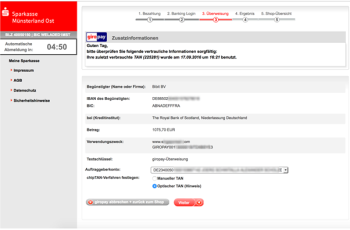

Desktop device

Above, the shopper selects Giropay from the various payment methods and is redirected to the Giropay page.

Above, the shopper enters the name of their bank. This, and the two screens below are optional they don't appear if you include the BIC/Swift (Business Identity Code) in the XML request.

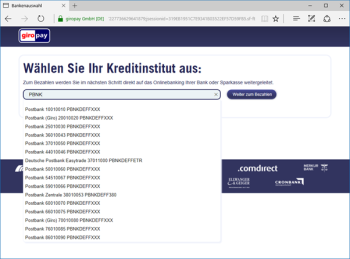

Above, the list of banks appear depending on the letters the shopper enters. Or the shopper can enter the BIC (Business Identification Code).

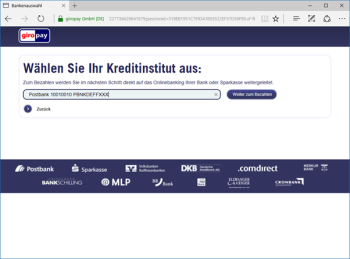

Above, the shopper selects the correct bank from the list and confirms their choice.

Above, the system redirects the shopper to their bank. This screen always appears. Shoppers complete the various fields.

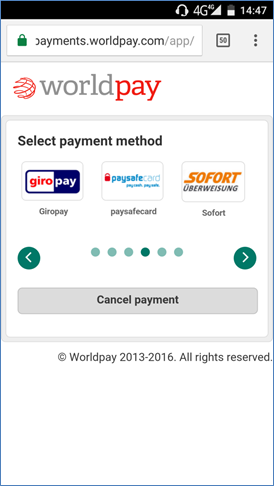

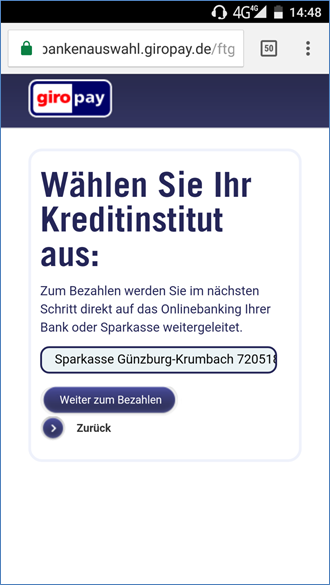

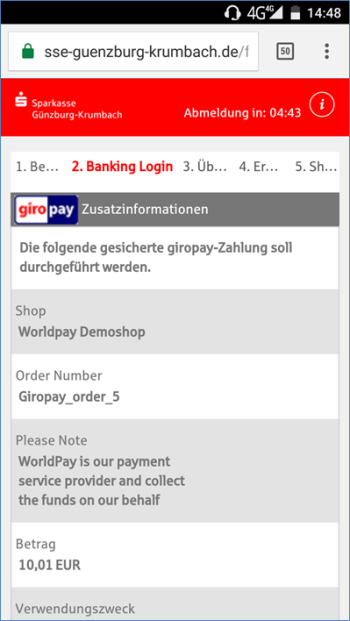

Mobile device

The Giropay screens are optimised for a mobile device, although some banks still have screens that are not optimised. The example screens below feature a bank which does have mobile optimised screens.

Above, the shopper selects Giropay as the payment method and the system redirects the shopper to the Giropay payment pages.

Above, the shopper enters the name of their bank. This screen is optional - it doesn't appear if you include the BIC (Bank Identity Code) in the XML request.

Above, the shopper lands on their bank page.

Above, the shopper enters their ID details and is redirected to a success URL after the payment is made.

Integration considerations

It is important that you think about the following information when you integrate with Giropay, in addition to the general integration recommendations elsewhere in this document.

Time out

A significant proportion of shoppers complete their payments within 5 to 6 minutes, as the payment process is relatively straightforward and various timeouts are enforced. Shoppers have:

- Up to five minutes to enter the BIC (Business Identifier Code) of on the BIC-capture page. This page is skipped completely if you pass the BIC in the XML.

- Up to five minutes to log into their bank.

- Up to five minutes to complete the payment once logged into their bank.

Exceptionally, there can be a short delay in receiving the authorisation confirmation from the bank.

You could therefore receive an authorisation notification up to 20 minutes (or in exceptional circumstances more) after the shopper was redirected. In general you will receive the authorisation within 5 – 6 minutes from the point of redirect.

Compatibility

Giropay works on both desktop and smaller devices. Note that not all banks have mobile-optimised pages, so you may find that acceptance rates are slightly lower if the shopper uses a mobile device. Worldpay continue to work with our partners to ensure that all our methods work optimally across a broad range of devices.

Logos

This is the general logo for online use:

This is the online (bank) transfer logo for online use:

Giropay may update their logo, slogans and font at any time. The logos and banners above are correct as of October 2019. To check and obtain the current logos and banners, see the Giropay website.

Payment method properties

| Property | Description/Value |

|---|---|

| Payment type | Bank transfer |

| Countries | Germany |

| Acceptance Currencies | EUR |

| Settlement to Worldpay Currency | EUR |

| Preferred Currency | EUR |

| Shopper Debit | EUR |

| Minimum amount for a single transaction |

EUR 0.1 We do not recommend that you offer Giropay for payments under EUR 1. |

| Maximum amount for a single transaction (Individual card issuers and banks may also impose their own limits) | EUR 50,000 |

| Direct Refunds (Yes/No) |

Yes. See the WPG Refunds Capability table for limitations. You can only do a direct refund on certain transactions (those where the bank has provided Worldpay with the shopper bank account details). Certain banks do not provide this data, but approximately two-thirds of your payments should be direct-refundable. You can only execute a direct refund after the payment has reached a SETTLED status +2 days. If Worldpay has enough data to offer a direct refund, then the direct refund button appears in the merchant interface. If we do not have enough data, no direct refund button appears and instead you must contact the shopper to get their bank details. |

| Direct Refund Period | See the WPG Refunds Capability table for limitations. |

| Bank Transfer Refunds (Yes/No) | Yes. See the WPG Refunds Capability table for limitations. |

| Bank Transfer Refund Period | See the Refunding Alternative Payments Guide for limitations. |

| Chargebacks (Yes/No) |

No All Giropay payments are guaranteed up to EUR 10,000. For individual payments greater than EUR 10,000, the first EUR 10,000 is guaranteed, but the remainder is not. In cases of fraud, the liability for this remainder is with you, the merchant. |

| Payment method mask | GIROPAY-SSL |

| Supported languages | DE |

| Statement narrative (Yes/No) | No |

| Dynamic descriptor | No |

| Payment traceability |

The merchant’s order code normally appears on the bank’s payment pages. |

| Direct model (Yes/No) | Yes |

| Redirect model (Yes/No) | Yes |

| Sandbox (Yes/No) | Yes |

| Service Level | M-Level |

| Restrictions | None |

Payment timetable

| Trigger | Delay | WPG payment status changes to | Notes |

|---|---|---|---|

| Shopper chooses the Giropay payment method | 0 | An order is created and the shopper is redirected to Giropay. | |

| The shopper successfully completes their payment on the Giropay and bank payment pages | <15 mins | ||

| PSP authorises the payment | ~5 mins | SENT_FOR_AUTHORISATION and then AUTHORISED | The payment is authorised in real time. The two payment status are created at the same time. |

| Worldpay capture the payment | <1 hour | CAPTURED | |

| Worldpay clears and settles the payment internally | 3 – 4 days | SETTLED | |

| Worldpay settles to the merchant | n working days | The settlement to the merchant occurs according to the normal merchant settlement cycle. |

Restrictions

Worldpay is obliged to follow Giropay’s regulations when we board merchants onto the Giropay service. These regulations state that merchants cannot offer the following types of goods or service. If in doubt, contact your Worldpay Relationship Manager (RM):

-

Any goods and services that are or become unlawful as such and their advertisement, offer or distribution is or becomes unlawful. This also applies to goods or services that are offered in connection with unlawful, obscene or pornographic contents, in particular.

-

Any goods and services whose advertisement, offer or distribution would breach copyrights and industrial property rights as well as other third-party rights (e.g. the right to one’s own image, name and personal rights).

-

Any goods and services that count as “illegal products” within the meaning of Section 4 of the Interstate Treaty on the Protection of Minors (Jugendmedienschutz-Staatsvertrag) (which, for example, represent propaganda material or symbols of unconstitutional organisations, glorify war, violate human dignity, portray children or minors in unnatural, sexually suggestive postures or are of a pornographic nature).

-

Archaeological finds.

-

Drugs, narcotics, mind-altering substances and other prohibited substances or agents.

-

Goods which are subject to a trade embargo.

-

Body parts and human remains.

-

National Socialist articles and publications.

-

Protected animals and protected plants.

-

-

Payment methods (cash money, book money or e-money, currencies including virtual currencies, as Bitcoins, and cheques) where the recipient of the payment (payee) cannot be identified by the merchant or Worldpay. This excludes coupons, value cards and vouchers.

-

Lotteries which do not hold a valid German gambling license.

-

Payment for online poker games.

-

Adult entertainment where the merchant does not hold the necessary permits under German law, or where their offer is not compliant with current German legislation (e.g. in regards to youth protection legislation).