Click here to search worldpay.com

Alipay

Alipay is a popular payment method that shoppers based in China use to make payments online from their Alipay eWallet.

With over one billion users, Alipay handles more than half of China's payments and transformed a cash market into a card-trusting market with their eWallet.

Built by internet shopping giant Alibaba to make it easier for their shoppers to buy and sell on their trading site, Alipay is now so popular that customers prefer to pay by mobile device in stores and online.

To integrate Alipay to your checkout, visit Worldpay developers and contact your Relationship Manager.

Shopper journeys overview

Shoppers must have an Alipay wallet to make a transaction.

If you are a merchant with a direct integration, it's important that your integration identifies the type of device the shopper is using, and presents the correct shopper journey. Journey 2 can work on a mobile device, but will be difficult to complete so conversion rates will be low.

For redirect merchants using our Hosted Payment Pages, shoppers will see:

- A button called 'Alipay' on desktop devices.

- A button called 'Alipay mobile' mobile devices.

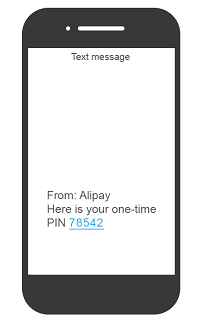

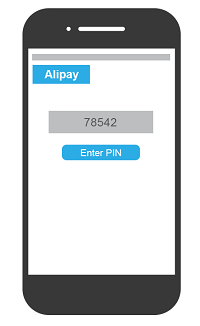

Note: All the journeys below can include a two-factor authentication challenge. This challenge is governed by Alipay's risk checks and is independent of Worldpay and merchants. Alipay has several methods to present two-factor authentication, including sending a one-time PIN by text message, QR codes or requesting some personal information from shoppers.

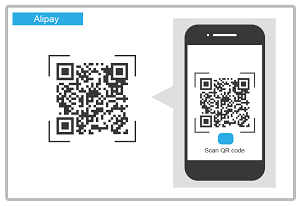

Shopper journey 1 - Desktop with QR code scanned on mobile device

The shopper is on a desktop device and scans the QR code on the payment page with their mobile device. This is the most popular way shoppers pay with Alipay.

|

|

|

|

Shopper selects Alipay on the desktop payment page |

On the Alipay desktop payment page, shopper sees a QR code |

Shopper opens the Alipay app on their mobile device, and scans the QR code |

|

|

|

|

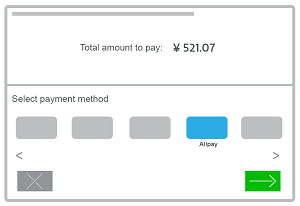

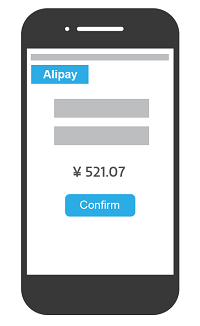

Shopper reviews the transaction information and confirms payment |

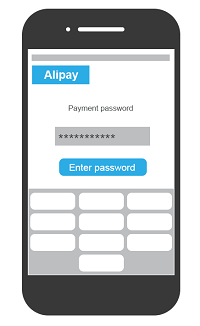

Shopper enters their payment password on the app. The password is verified |

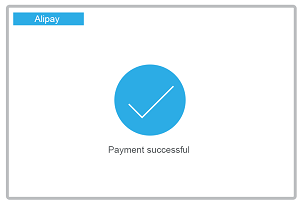

Payment confirmed successful on Alipay mobile app |

|

||

|

Payment confirmed successful on desktop payment page |

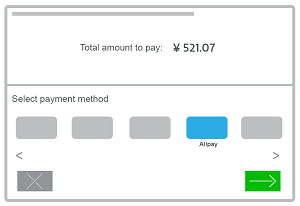

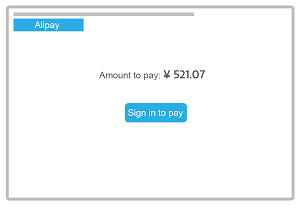

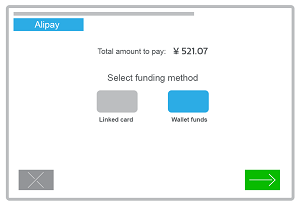

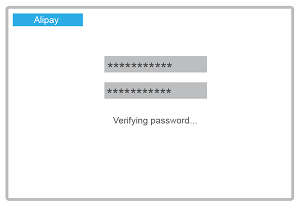

Shopper journey 2 - Desktop device and shopper logs in to Alipay

The shopper is on a desktop device and logs in to Alipay to confirm the payment.

|

|

|

|

Shopper selects Alipay on the desktop payment page |

Shopper selects the pay-on-screen option and signs in |

Shopper selects their funding method (Alipay wallet funds, linked card or other) |

|

|

|

|

Shopper enters their payment password |

Payment confirmed successful on Alipay desktop page |

Payment confirmed successful on desktop payment page |

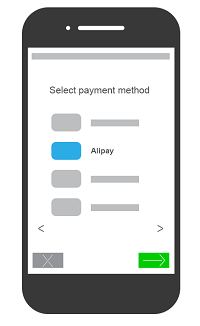

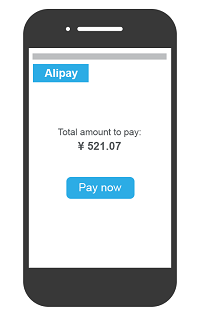

Shopper journey 3 - Mobile device with the Alipay app

The shopper is on a mobile device with the Alipay app installed and configured.

|

|

|

|

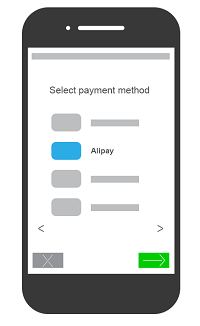

Shopper selects Alipay on mobile payment page |

Alipay mobile app automatically opens |

Confirmation screen with amount to pay appears |

|

|

|

|

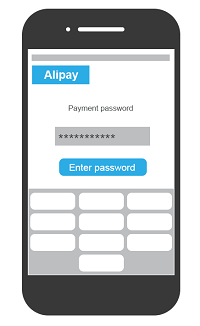

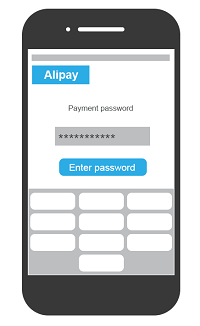

Shopper enters their password |

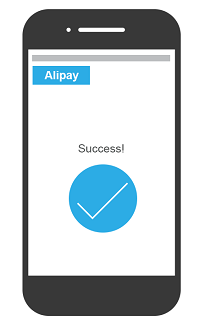

Payment confirmed successful. App closes automatically |

Payment confirmed successful on mobile payment page |

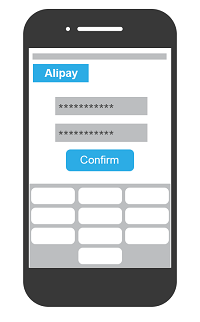

Shopper journey 4 - For mobile devices without the Alipay app

The shopper is on a mobile device without the Alipay app installed.

|

|

|

|

Shopper selects Alipay on mobile payment page |

Shopper enters phone number or email address |

(optional Alipay risk check) Shopper receives One-Time PIN by text message |

|

|

|

|

(optional Alipay risk check) Shopper confirms PIN on the app |

Shopper confirms their payment password |

Payment confirmed successful |

|

||

|

|

Payment confirmed successful on mobile payment page |

|

Payment method properties

| Property | Description/ Value |

|---|---|

|

Payment type |

eWallet |

|

Countries |

Worldpay supports the Chinese version of the Alipay wallet, where the wallet-holder must be a Chinese national. We hope to support other versions of the Alipay wallet in the future.

Alipay can be offered to shoppers on our Hosted Payment Pages for the following countries:

China Australia Canada Hong Kong Japan New Zealand Singapore South Korea Taiwan Thailand United States |

|

Acceptance Currencies |

CNY, GBP, EUR, USD, AUD, CAD, HKD, SGD, JPY. |

|

Currency combinations |

Worldpay can support like-for-like (authorization -> merchant transfer) in the following currencies GBP, EUR, USD, AUD, CAD, SGD, HKD, JPY. For any other currency combinations (e.g. authorization in CNY) there will be an FX charge between the authorization currency and merchant transfer currency. We can authorize payments in any of the above acceptance currencies, and transfer to the merchant in any of the published Worldpay transfer currencies. |

|

Preferred Currency |

CNY |

|

Shopper Debit Currency |

CNY. The shopper's Alipay wallet is always denominated in renminbi. |

|

Minimum amount for a single transaction |

1 CNY |

|

Maximum amount for a single transaction (Individual card issuers and banks may also impose their own limits) |

10,000 USD or local currency equivalent. |

|

Direct Refunds (Yes/No) |

Yes. See How long you have to refund - Direct Refunds in Worldpay Developers. |

|

Bank Transfer Refunds (Yes/No) |

No |

|

Chargebacks (Yes/No) |

No. Chargebacks are not supported and payments are guaranteed. Alipay will only re-credit the shopper and debit you, the merchant, if Alipay receive a shopper complaint and there is evidence that you have compromised the security of that payment. |

|

Payment Method Mask |

ALIPAY-SSL or ALIPAYMOBILE-SSL for an integration optimized for mobile devices |

|

Supported Languages |

ZH |

|

Statement Narrative (Yes/No) |

Yes. It is best practice to populate this field with a narrative your shopper will recognize, increasing your shoppers confidence to complete the payment. |

|

Dynamic Descriptor (Yes/No) |

Yes. It is best practice to populate this field to allow the shopper to recognize the transaction on their bank statement. |

|

Payment Traceability |

Payment ID - this is searchable in Worldpay’s Back Office system. It is shown on the Alipay payment pages and the shopper's Alipay statement. Order Code - this is searchable in the MAI and in Worldpay’s Back Office system. It is shown on the Alipay payment pages and the shopper’s Alipay statement. |

|

Direct Model (Yes/No) |

Yes |

|

Hosted Payment Pages (HPP) Model (Yes/No) |

Yes |

|

Sandbox (Yes/No) |

Yes for ALIPAY-SSL No for ALIPAYMOBILE-SSL Use ALIPAY-SSL to test the integration. In the future, we plan to improve Sandbox so it can test Alipay Mobile. |

|

Service Level |

M-Level |

White-listed sectors

As a merchant, you can only offer Alipay to your customers if your MCC is present on a white-list of MCCs that Alipay maintain. Please contact Worldpay to obtain the latest list and discuss your requirements.

If you are in the process of integrating Alipay to your checkout with Worldpay, your Implementation Manager will discuss this requirement with you.

Restricted Sectors

The below list of restricted sectors is correct as of April 2019 and is subject to change by Alipay at any time. You may be allowed to sell these services with Alipay under certain circumstances. Your Worldpay Implementation Manager will advise you accordingly at the time of boarding.

| Cigarettes and other tobacco products | Devices and equipment which need permission from the government or other authorities before they can be operated (e.g. broadcasting equipment, radio transmitters) |

| Medicines, medical devices and equipment not already listed in the prohibited list |

Prohibited sectors

The below list of prohibited sectors is correct as of April 2019 and is subject to change by Alipay at any time. You cannot use Alipay to sell these kinds of goods or services.

| All religious websites, publication or accessories | Narcotics and related accessories |

|

Anesthetic, psychotropic or prescription medicine, illegal unregistered medicine |

Online cemeteries and ancestor worshiping |

| Archaeological and cultural relics | Online sale of medical services, including medical consulting, hypnotherapy, plastic surgery |

| Aphrodisiac | Online sale of tobaccos and cigarettes |

| Auction sites and services | Pawn services |

| Batons and electric batons | Payment by installments service |

| Cash disbursement from credit funding sources (e.g. credit cards) | Peer to peer (P2P) lending services |

| Charitable organizations | Poisonous or hazardous chemicals |

| Counterfeit currency | Pornographic and vulgar audio visual products, channels and publications |

| Counterfeit or replica food products | Pornographic and vulgar erotic services |

| Crowd funding | Protected species |

| Crude oil | Pyramid schemes and multilevel marketing |

| Espionage equipment and accessories | Real estate |

| Fetal gender determination | Rebate or cashback services |

| Financial products and services | Sale of animals, plants or products originating from areas declared with an epidemic outbreak of contagious diseases |

| Fireworks and firecrackers | Sale of animals, plants or products with contagious and hazardous diseases |

| Foreign exchange services | Sales of distribution of event tickets without license (e.g. Olympic Games or World Expo tickets) |

| Gambling devices and accessories | Sales of personal information (e.g. identity card information) |

| Gambling service | Satellites and antennas |

| Gold investment | Seeds |

| Hacking services or accessories | Services or products facilitating unlawful public gathering |

| Human organs | Services or products that infringe on personal privacy (e.g. online activity monitoring) |

| Illegal or un-registered fund-raising activities | Services to facilitate plagiarism and examination fraud |

| Illegal political audio visual products and publications | Single-purpose prepaid cards (including gift cards and other stored value cards) |

| Illegal political program channels | Smuggled goods |

| Illegal publication of certificates or carving of stamps | Software or products related to trading of financial products and information |

| Illegal sale of financial information (e.g. bank accounts, bank cards) | State secret documents and information |

| Illegally obtained proceeds or properties as result of crime | Stock and securities |

| Insurance products and platforms | Surrogacy services |

| Lock picking tools and accessories | Trading in invoices issued within the Peoples’ Republic of China |

| Lottery | Trading or distribution of currency (both RMB and foreign currencies) |

| Lucky draws | Trading or sale of virtual currencies (e.g. Bitcoin, Litecoin) |

| Malwares | Video chatting services |

| Military or police equipment | Weapons of all types (including daggers, firearms and accessories), replica weapons, ammunition and explosives) |

| Mutual Funds |