Reconciliation Report

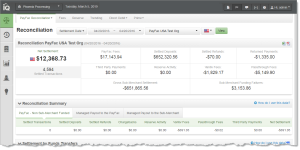

The Reconciliation report view of the PayFac Reconciliation Dashboard provides an overall summary for the Payment Facilitator in the top summary panel, and summaries in the form of tabs for each of the three funding models in the Reconciliation Summary panel (as shown below):

-

PayFac - Non Sub-Merchant Funded - details the net settlement amount you received for sub-merchants in your portfolio not using Managed Payout.

-

Managed Payout to the PayFac - details the net settlement amount you received for sub-merchants in your portfolio using Managed Payout.

-

Managed Payout to the Sub-Merchant - details the net settlement amount sub-merchants received for sub-merchants in your portfolio using Managed Payout.

PayFac Reconciliation (Roll-Up) Summary Panels

The table below describes the fields in the overall PayFac Reconciliation summary panel. Reconciliation Summary Fields - All Tabs (below) describes the fields in each of the tabs of the Reconciliation Summary panel. The sections starting with Activity Date View - Transaction Summary by Purchase Currency describe each of the detail data panels in each view (settlement or activity).

|

Field |

Description |

|

Net Settlement |

The net amount transferred to your organization’s bank account. |

|

Settled Transactions |

The number of transactions that were settled in the specified time period. |

|

PayFac Fees |

The total amount of fees payable to the Payment Facilitator from the sub-merchant. |

|

Settled Deposits |

The total amount of settled deposits before the deduction of any fees, reserves, or chargebacks. |

|

Settled Refunds |

The total amount of settled refunds before the deduction of any fees. |

|

Returned Payments |

The amount of funds associated with chargebacks, Direct Debit returns, and rejected payments, including:

|

|

Third Party Payments |

The fees paid to a third party by Worldpay on behalf of your organization. |

|

Reserve Activity |

The changes made to the reserve fund based upon gross sales. If you sell in multiple currencies, this only reflects the Reserve Activity for the selected currency. |

|

Worldpay Fees |

The amount of funds associated with transaction processing charges. If you sell in multiple currencies, this only reflects the Worldpay Fees for the selected currency. |

|

Passthrough Fees |

The amount of funds associated with charges assessed by parties other than Worldpay (for example, interchange fees). If you sell in multiple currencies, this only reflects the Passthrough Fees for the selected currency. |

|

Gross Sub-Merchant Settlement |

The gross funds settling directly to the sub-merchants before the deduction of PayFac fees and sub-merchant funding failures. |

|

Sub-Merchant Funding Failures |

The total amount of direct sub-merchant fund transfers that Worldpay received returns against. |

The following table describes the fields in each of the tabs in the Reconciliation Summary Panel:

-

PayFac - Non Sub-Merchant Funded

-

Managed Payout to the PayFac

-

Managed Payout to the Sub-Merchant.

|

Field |

Description |

|

PayFac - Non-Sub-Merchant Funded: this tab breaks down the net settlement you received for Sub-Merchants in your portfolio not using Managed Payout. |

|

|

Settled Transactions |

The number of transactions that were settled in the specified time period. |

|

Settled Deposits |

The total amount of settled deposits before the deduction of any fees, reserves, or chargebacks. |

|

Settled Refunds |

The total amount of settled refunds before the deduction of any fees. |

|

Chargebacks |

The amount of funds associated with chargebacks, Direct Debit returns, and rejected payments, including:

|

|

Reserve Activity |

The changes made to the reserve fund based upon gross sales. If you sell in multiple currencies, this only reflects the Reserve Activity for the selected currency. |

|

Worldpay Fees |

The amount of funds associated with transaction processing charges. If you sell in multiple currencies, this only reflects the Worldpay Fees for the selected currency. |

|

Passthrough Fees |

The amount of funds associated with charges assessed by parties other than Worldpay (for example, interchange fees). If you sell in multiple currencies, this only reflects the Passthrough Fees for the selected currency. |

|

Third Party Payments |

The fees paid to a third party by Worldpay on behalf of your organization. |

|

Net Settlement |

The net amount transferred to your organization’s bank account. |

|

Managed Payout to the PayFac: this tab breaks down the net settlement you received for sub-merchants in your portfolio using Managed Payout. |

|

|

Settled Transactions |

The number of transactions that were settled in the specified time period. |

|

PayFac Fees |

The total amount of fees payable to the Payment Facilitator from the sub-merchant. |

|

Sub-Merchant Funding Failures |

The total amount of direct sub-merchant fund transfers that Worldpay received returns against. |

|

Worldpay Fees |

The amount of funds associated with transaction processing charges. If you sell in multiple currencies, this only reflects the Worldpay Fees for the selected currency. |

|

Passthrough Fees |

The amount of funds associated with charges assessed by parties other than Worldpay (for example, interchange fees). If you sell in multiple currencies, this only reflects the Passthrough Fees for the selected currency. |

|

Reserve Activity |

The changes made to the reserve fund based upon gross sales. If you sell in multiple currencies, this only reflects the Reserve Activity for the selected currency. |

|

Third Party Payments |

The fees paid to a third party by Worldpay on behalf of your organization. |

|

Settled Refunds |

The total amount of settled refunds before the deduction of any fees. |

|

Chargebacks |

The amount of funds associated with chargebacks, Direct Debit returns, and rejected payments, including:

|

|

Net Settlement |

The net amount transferred to your organization’s bank account. |

|

Managed Payout to the Sub-Merchant Tab: this tab breaks down the payout to sub-merchants in your portfolio using Managed Payout. |

|

|

Settled Transactions |

The number of transactions that were settled in the specified time period. |

|

Settled Deposits |

The total amount of settled deposits before the deduction of any fees, reserves, or chargebacks. |

|

Settled Refunds |

The total amount of settled refunds before the deduction of any fees. |

|

Chargebacks |

The amount of funds associated with chargebacks, Direct Debit returns, and rejected payments, including:

|

|

PayFac Fees |

The total amount of fees payable to the Payment Facilitator from the sub-merchant. |

|

Settlement to Sub-Merchant |

The net settlement to sub-merchants (gross settlement minus PayFac fees and sub-merchant funding failures). |