FraudSight

Fraudsters constantly evolve their methods as the payments environment changes. So too, must fraud defences evolve to remain effective. After widespread implementation of EMV for card-present transactions and the increase of card-not-present eCommerce spending, fraudsters are not slowing down. Instead, they are now targeting the card-not-present and the non-EMV compliant space due to the vulnerabilities that exist in these channels.

FraudSight is a multilayered fraud solution that combines data insights, technology, and our team of fraud experts to predict if a transaction is at high risk for fraud. FraudSight leverages Worldpay’s vast transaction visibility, machine learning technology, and global expertise to help merchants protect their commerce experience.

FraudSight has two offerings. Each tier has unique configurations for transaction decisioning, which we designed to meet the needs of merchants in specific areas of their business.

- Protect – designed for merchants who do not have an in-house fraud operations team and would prefer to let Worldpay manage fraud strategy and mitigation on their behalf.

- Premier – designed for merchants who may have a fraud or other team managing fraud in-house and would prefer to work with Worldpay to develop custom fraud strategies specific to their business.

TABLE 1-8 FraudSight Tiers

|

Feature |

Protect |

Premier |

Description |

|---|---|---|---|

|

Real-time Fraud Decision and Score |

X |

X |

FraudSight analyzes a transaction in milliseconds and renders a score between 0 - 1000. Working with our fraud strategy team, you determine thresholds that dictate whether the transaction approves, declines, or moves to the Manual Review queue. |

|

Fraud Reports |

X |

X |

We produce detailed analytics on a define cadence, which shows FraudSight performance and provides information you can use to fine-tune results, if necessary. |

|

Device and Behavioral Data |

X |

X |

The addition of a few lines of JavaScript on your checkout page allows FraudSight to capture information about the consumer's device and behavior during checkout. This provides additional data points, enhancing the ability of FraudSight to recognize potentially risky behavior. |

|

Fraud Consulting Desk |

|

X |

Worldpay employs a group of fraud experts who work with you. They can answer questions, discuss new fraud trends, propose and test new fraud rules/strategies, and provide recommendations on how to improve your fraud mitigation capabilities. |

|

Fraud Dashboards |

|

X |

FraudSight dashboards provide granular visibility into your fraud activity, allowing you to drill down and interact with multiple data points and increase your understanding of fraud. |

|

Custom Rules |

Optional |

X |

Custom rules provide you the added flexibility you need to ensure the optimization of FraudSight for your business. You can tell Worldpay when to turn on a rule, or can work with Worldpay to identify potential rules that may enhance the ability of FraudSight to stop more bad transactions while accepting more good. |

|

Manual Reviews |

Optional |

Optional |

Based upon thresholds you set, FraudSight can send transactions to a manual review queue. After examining the transactional information using the dashboard or via API, you can choose to accept or decline the transaction. Alternatively, you can choose to let our fraud experts manage the manual review process. |

|

Basic Filters |

Optional |

Optional |

FraudSight offers a set of nine optional filters that work to assess specific areas of risk behavior. |

Applying FraudSight Pre-Network or Post-Network

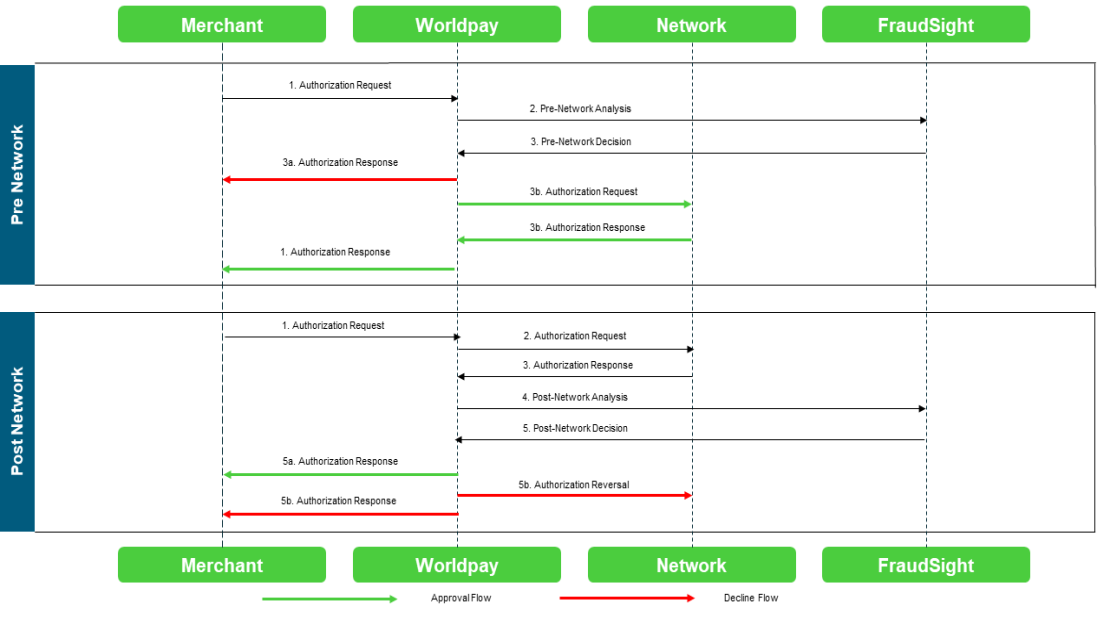

You have a choice of having FraudSight check the transaction before we forward it to the card brands, Pre-Network, or after we receive a response from the card brands, Post-Network. The diagram below and the text that follows highlights the difference between implementation methods.

Pre-Network Flow

- You submit an Authorization or Sale request.

- FraudSight analyzes the transaction using machine learning, as well as your rules and strategies.

- FraudSight either approves or declines the transaction.

- If FraudSight declines the transaction, you receive the transaction response along with FraudSight’s decision and score.

- If FraudSight approves the transactions, Worldpay sends the request to the card networks. You receive the transaction response along with FraudSight’s decision and score.

Post-Network Flow

- You submit an Authorization or Sale request.

- Worldpay submits the Authorization or Sale request to the applicable card network.

- Worldpay receives the response back from the card network.

- FraudSight analyzes the transaction using machine learning, as well as your rules and strategies.

- If FraudSight approves the transactions, you receive the authorization response along with FraudSight’s decision and score.

- If FraudSight declines the transaction, Worldpay initiates an authorization reversal on your behalf. You receive the transaction response.